Assistant auditor Anton Kyreiev

One of the most important tools for auditing at the current stage is the digitalization of the processes involved. In general, digitalization is the use of modern digital technologies for automatization and optimization of certain processes in any kind of activity.

In audit, for example, the accounting information processing system for accounting personnel, financial department management and the company's Chief economist provides tools for automatic and intelligent editing of work processes and can improve the productivity and timeliness of financial management, contributing to the overall effectiveness of financial management. The purpose of this article is to research the latest methods of digitalization of accounting information processing and its application in practice.

Main material overview

Accounting information processing system for such personnel: accounting, management of the financial department, and the Chief economist of the company. It can be used for: providing tools for automatic and intelligent editing, auditing, processing, publishing, and financial management at the enterprise of various work processes. This can improve the real timeliness of financial management and increase its efficiency. In general, digital systems use the “.NET” technology: for software development, accounting process of recording vouchers, general ledger, reporting and other system requirements, analysis and planning of functions, implementation and management of client archives, processing of accounting checks, and other functional modules. Digital accounting systems are, by their nature, more reliable than manual accounting.

In audit processes, this can include the use of software to automate and analyze the data collection, the use of cloud technologies for collaborating and storing the documents, and the use of machine learning and Artificial Intelligence to identify the patterns and anomalies within the data.

Let's consider ways of digitalizing the audit processes in both private and public sectors of the economy.

- Creation of centralized analytical resources.

- Use of interactive approaches.

- Adaptation of electronic accounting systems and digital information processing.

- Simplifying data analysis using macros..

The creation of centralized analytical resources in both public and private sectors of the economy is a key step for improving audit and financial management. This approach involves combining various analytical functions and tools into a single center, which ensures consolidation and standardization of analytical activities.

Firstly, the creation of centralized analytical resources allows for the efficient use of data processing and analysis on a large scale. This is important, because the volumes of financial and economic data in the public sector can be significant, and their processing in a centralized form makes it easier to identify key trends and risks.

The second aspect consists of providing a single methodology and standards of analysis, contributing to the homogeneity of the results, reducing the risks of false conclusions. This is important to ensure reliability and objectivity of analytical procedures. Leading state banks can serve as an example. In case of Ukraine, JSC CB “PrivatBank” can be mentioned. The number of transactions that pass through their system is hundreds of millions (especially regarding having 19 million customers, according to the bank's official page), which also creates difficulties for information processing. Therefore, to solve these problems, data centralization is required in a simpler form based on adaptive software complexes.

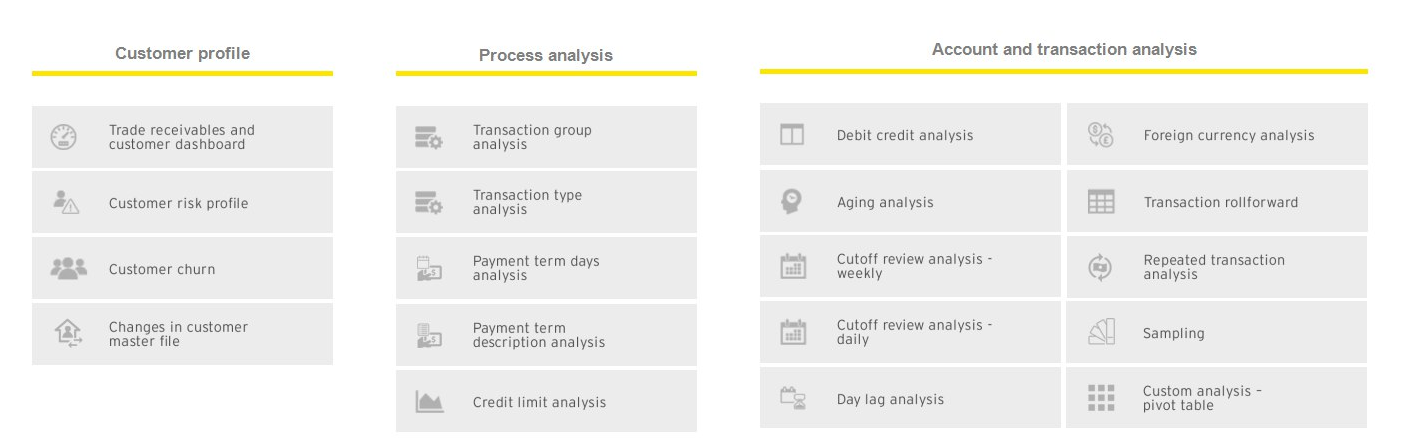

The use of interactive approaches in audit and financial management in both public and private sectors is a key direction for increasing the efficiency and accuracy of analytical procedures. This approach involves the use of specialized interactive tools that allow auditors to interact with financial information in real time. The use of interactive approaches facilitates the rapid analysis of large amounts of data and the identification of patterns and trends, which simplifies the assessment of potential risks and anomalies. This approach also allows auditors to actively interact with clients and stakeholders throughout the audit process, ensuring a more effective exchange of information and promoting mutual understanding between all the participants. This could be a software complex, where audit participants from both sides interact with each other to receive, adjust, and process the requests with markings of deadlines for submitting information in real time.

The adaptation of electronic accounting systems in the public sector of audit has enormous potential for improving the efficiency and accuracy of the processes. It covers the automation of accounting operations, digital tools for analyzing financial statements and the use of software to verify compliance with the regulations. The use of electronic systems helps to decrease opportunities for error and fraud, providing a more accurate and reliable audit process. In addition, it allows for quick access to the information, facilitating interaction between auditors and clients. An important step is to take security measures and ensure the confidentiality of electronic systems to maintain confidence in the audit results in public sector.

For example: “QuickBooks”, “Sage”, “Xero” automatically allocate expenses by category, track payments with suppliers and prepare reports according to the requirements of the accounting standard.

“QuickBooks” is an accounting software product developed by Intuit company. It contains a variety of business management tools, including tracking income and expenses, creating and managing accounts, preparing tax reports, and analyzing business processes. QuickBooks is available for both large and small businesses and can be used online or as server-based software.

“Sage” is a powerful solution for accounting and financial data management developed by Sage Group. The program offers a wide range of features, including asset accounting, payroll, auditing and more. Sage is especially popular among medium and large companies and is available in several versions, including cloud solutions.

“Xero” is a modern cloud accounting and bookkeeping service for small and medium-sized businesses. With its help, you can track income and expenses, manage accounts, prepare taxes and make online payments. Due to the cloud-based data storage technology, Xero allows you to connect from any device with Internet access.

“CaseWare IDEA”, “ACL”, “TeamMate” can automatically analyze large volumes of data, identify deviations from the norm, conduct compliance checks, and generate detailed reports.

“CaseWare IDEA” is an audit and data analysis product widely used by accounting and finance departments. Its functionality includes the ability to process large amounts of data, search for complex patterns and trends, detect errors or fraud. It is a powerful tool that can greatly simplify auditing and quality control.

“TeamMate” is an audit management system developed by Wolters Kluwer. It enables auditors and audit engagement teams to manage all the aspects of an audit. “TeamMate” can help to organize the audit process, from planning to execution and report preparation, everything in one place. “IBM Watson”, “Microsoft AI”, “Google AI” can analyze large volumes of unstructured data (for example, text documents, audio and video recordings), identify patterns or anomalies and provide predictive data to assist the auditors.

“IBM Watson” is an artificial intelligence platform from IBM that is used for processing large amounts of data, automating business processes, developing decision support tools, as well as the other applications. Watson analyzes unstructured data, engages in dialogue with people in their native language, and learns through experience.

“Microsoft AI” is a set of various artificial intelligence technologies provided by Microsoft. It includes everything from machine learning and intelligent bots to cognitive services capable of recognizing speech and faces. “Microsoft AI” is used for various purposes such as application development, data analytics, process automation, etc.

“Google AI” is a portfolio of artificial intelligence tools and technologies developed by Google. It combines everything from machine learning systems to products that use artificial intelligence to improve the user experience (such as Google Assistant). The “Google AI” goal is to make artificial intelligence more accessible and useful.

Firstly, digital information processing allows to automate many routine processes, providing a more efficient and accurate data analysis. For example, audit software solutions such as “ACL” or “CaseWare IDEA” can automatically process large amounts of financial data and identify possible inconsistencies or deviations from the norm. This significantly reduces the risk of errors and ensures greater reliability of audit results.

In addition, digital data processing allows for more comprehensive in-depth analysis. The application of machine learning and artificial intelligence can help identifying complex patterns or trends that may remain unseen through traditional analysis. For example, “IBM Watson” software uses AI to analyze unstructured data, such as text documents or audio recordings, and identify potential problems.

Also, digital technologies can significantly improve collaboration and communication in the audit process. For example, using cloud technologies such as Google Drive or Dropbox.

“Google Drive” is a cloud service for data storage developed by Google. It allows users to store files in the cloud, syncing them between different devices and sharing them with others. The service also includes Google office applications (Docs, Sheets, Slides), which allows users to create, edit and work with documents together and in real time.

“Dropbox” is a cloud storage service that allows users to store data on servers in the cloud, synchronizing files on different devices, and sharing them. With Dropbox, users can easily store and share files, track changes to files, share them with others, and even work on them together in real time.

Auditors can easily share the data with clients, work on documents together in real time, having access to all the necessary information from anywhere and at any time. This can significantly speed up the audit process and make it more convenient for all the parties.

Simplifying data analysis with the help of macros is a method of working with a document that is nowadays actively used in leading auditing companies at certain stages of the audit. Macros are automated procedures that can be used to perform a number of tasks. They are often used in programs such as Excel to automate routine or complex calculations.

For example, if you need to analyze a large set of data about a company's financial transactions, you can create a macro that will automatically sort those transactions by date, transaction type, and amount, which can help isolate anomalous transactions. Starting data analysis always involves transferring or uploading data to the appropriate software. To do this, you can either enter data manually or use the special tools for their import. Once the data is uploaded, the criteria for analysis should be defined. For the analysis of the company's financial transactions, for example, it could be the date, the type of transaction and the amount of money that was in circulation.

Fig.1 – An example of using the macros in auditing to compile a client transformation file.

Another example is creating a macro to automatically calculate the important financial metrics, such as pre-tax profit, return on assets, or liquidity ratio. This can significantly speed up the analysis process and provide more accurate and consistent results. To begin the process of calculating important financial indicators, you must first load the relevant data into Excel. Those could be various financial statements, balance sheets, profit and loss data, etc., that may be crucial for calculating indicators such as profit before tax, return on assets or liquidity ratio.

At the next stage, you need to define formulas for calculating the necessary indicators and other variables that need to be considered. This could include a detailed analysis of each indicator and the development of appropriate mathematical models. Afterwards, you need to create a macro that would automatically calculate these indicators for the entire data set. Macros can automate complex calculation processes and allow you to quickly get the results from a large amount of data. Using the created macro, you can automatically analyze the accumulated data and get important indicators in just a few clicks. This significantly reduces the time it would take to manually calculate these indicators and ensures greater overall accuracy of the analysis. Finally, the obtained results could be used to further analyze the financial health and success of the company, identify weak points, and develop recommendations for possible improvements.

An important advantage of using macros is the ability to change tabular data without creating a new macro, which significantly simplifies the auditor's technical work.

Conclusions from BDO in Ukraine specialists

Having analyzed the above, one should conclude that such systems should be adopted in the audit sector for the purpose of effective analysis. It is obvious that software packages focused on the analysis of digital information illustrate a broader perspective of the picture than any other procedure of such kind. However, in some cases, it would be impossible to apply these programs, since the calculations of certain indicators require complex analysis, and the software is not configured for certain situational tasks, for which it would be necessary to create special conditions, and, therefore, to reconfigure the corresponding programs.On the other hand, the problem within the analysis of financial statement articles according to analytical procedures is that analytical procedures require a high level of professional competence from the auditor, who must be able to determine the expected values of the indicators, choosing the appropriate sources of information, applying various methods of analysis and evaluation, interpreting the results, and making conclusions. With digitalization, this problem is partially solved by reducing the workload on the auditor, narrowing the spectrum of concentration. It is still worth noting that there are certain threats associated with limitations, insufficient quality of data, wrong choice of comparative base, influence of external factors, impossibility to consider all the deviations and their causes, risk of not detecting significant errors and misstatements. They also require proper documentation, which should reflect the purpose, nature, timing, and the degree of performance of analytical procedures, data sources, methods of analysis and evaluation, results, and conclusions, as well as measures taken to solve identified challenges.