Ukrainian construction industry situation and challenges in the second year of the war reviewed by the experts of “The Construction and Real Estate” industry group of BDO in Ukraine.

In 2023, the second year of russia’s full-scale invasion, various sectors of the economy faced new challenges. Apart from shellings and other risks, associated with the hostilities, businesses had to adapt to changes in regulations, including legislation, as well as to changes in consumer sentiment for goods and services. In particular, there was an increase in demand for purchasing own housing in the real estate market last year.

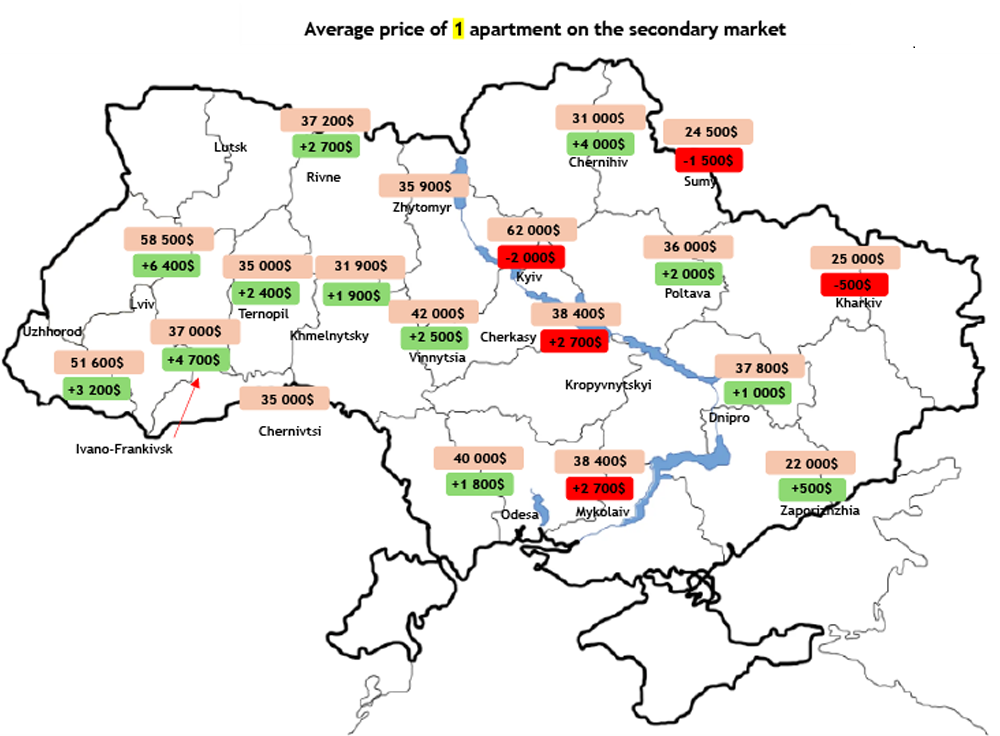

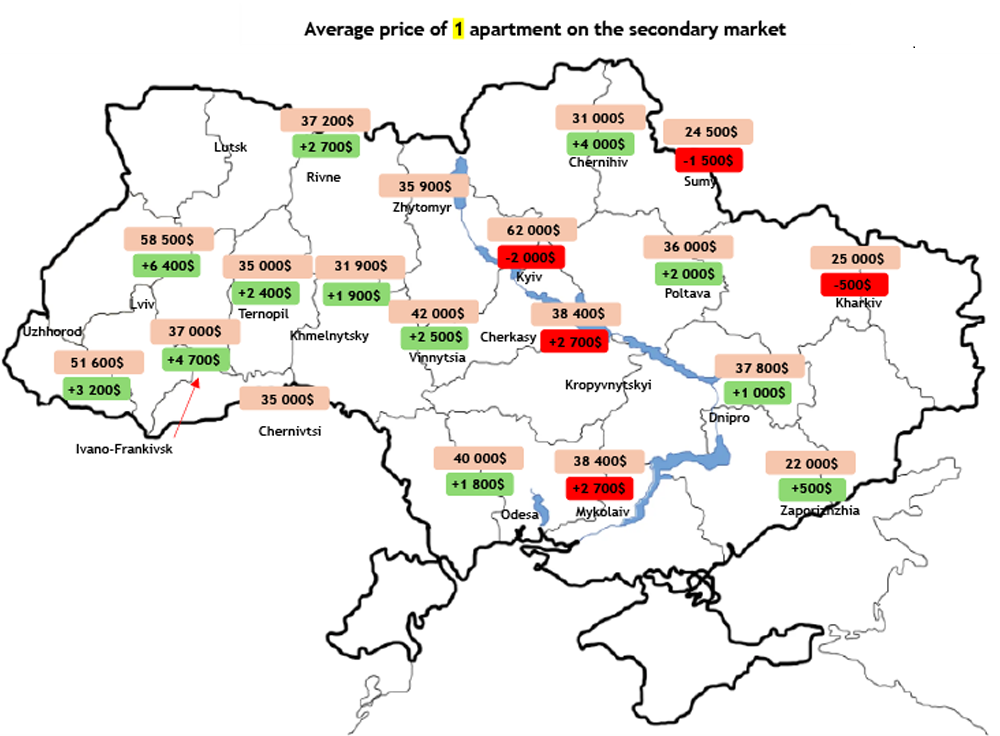

The cost of residential real estate in regions far from the war zone has increased. The only exception is the capital, which has minimally reduced average prices since the end of the blackouts, in the spring of 2023. This is likely due to migration processes.

In terms of 1-room apartments, Kyiv lost 3% in price, while the price in Lviv increased by 12%. Ivano-Frankivsk became the record holder in terms of price increase of +18% in foreign currency.

In terms of two-rooms apartments: Vinnytsia demonstrated an increase of 18% in price, Ivano-Frankivsk — by 17%, Lviv — by 9%, and Kyiv demonstrated a price decrease of -1%.

Three-room apartments in the capital fell by 6%, in Vinnytsia and Ivano-Frankivsk they increased by 13%, and in Lviv they went up by 8% in foreign currency.

Absolute number of the most popular option among Ukrainians is 1-room apartments, the capital lost the most, where apartments fell by $2000 for an average. Prices increased the most in Lviv (+$6400), Ivano-Frankivsk (+$4700) and Chernihiv (+$4000), which is even ahead of Uzhhorod (+$3200).

Kyiv and Lviv have traditionally been the most expensive cities to buy a home in, but with the outbreak of full-scale war, Uzhhorod was added to the list, where you need to save a bit more than over 9 years of full average local salaries to buy an apartment.

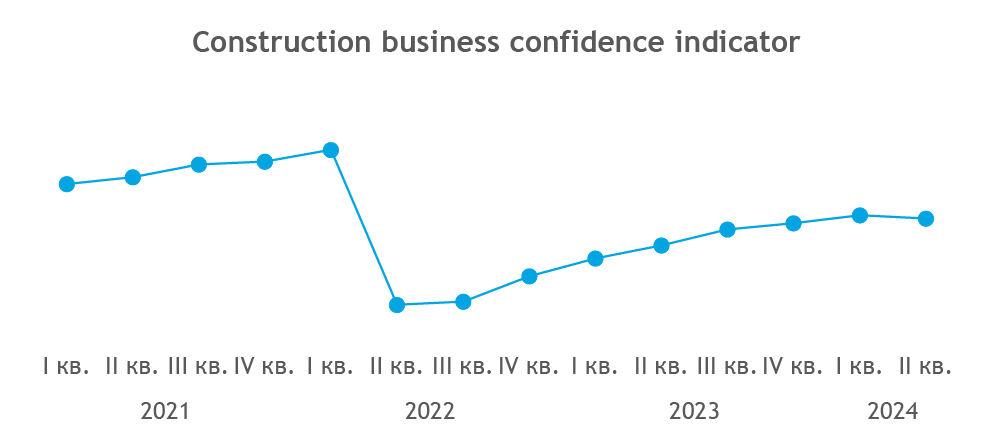

Businesses improved their expectations for business activity over the next 12 months. Despite security risks and logistical difficulties, including problems with border crossings, respondents forecast moderate growth in production of goods and services and were positive about the development of their businesses. Inflation expectations continued to improve, while currency expectations deteriorated slightly.

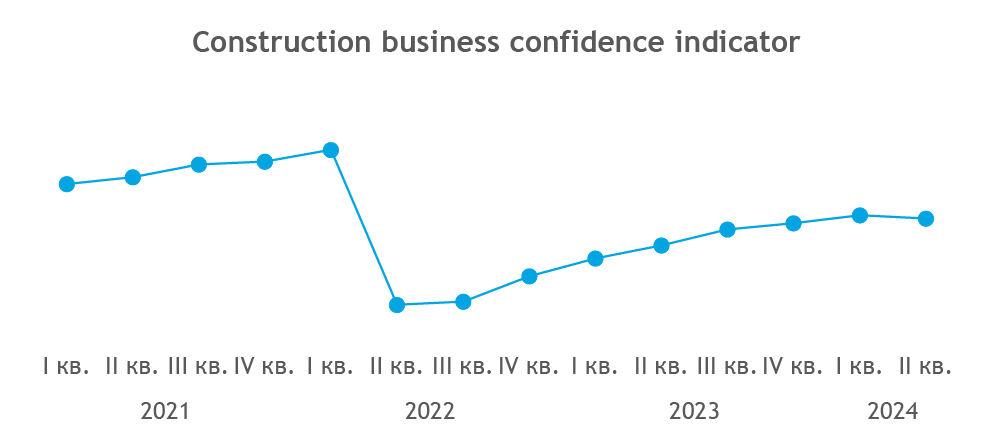

In the second quarter of 2024, the indicator of business confidence in construction decreased by 1.1 points compared to the first quarter of 2024 and amounts 40.9%.

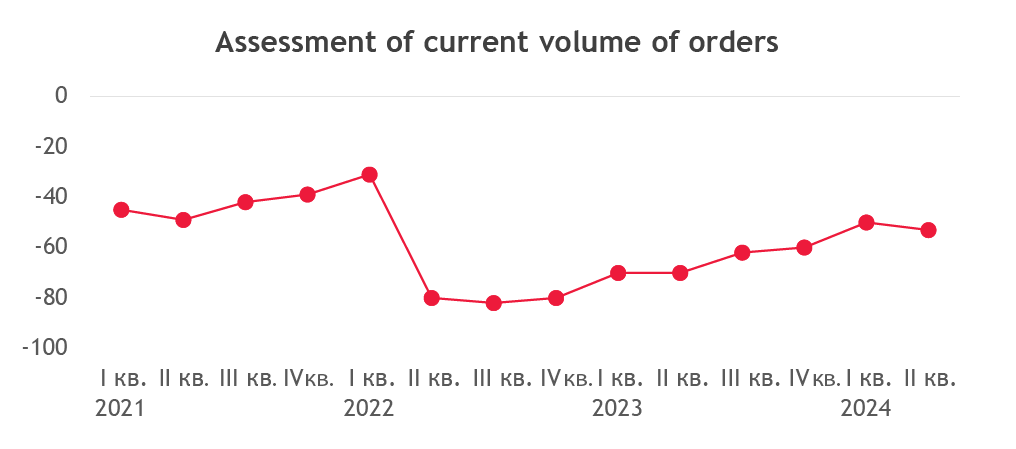

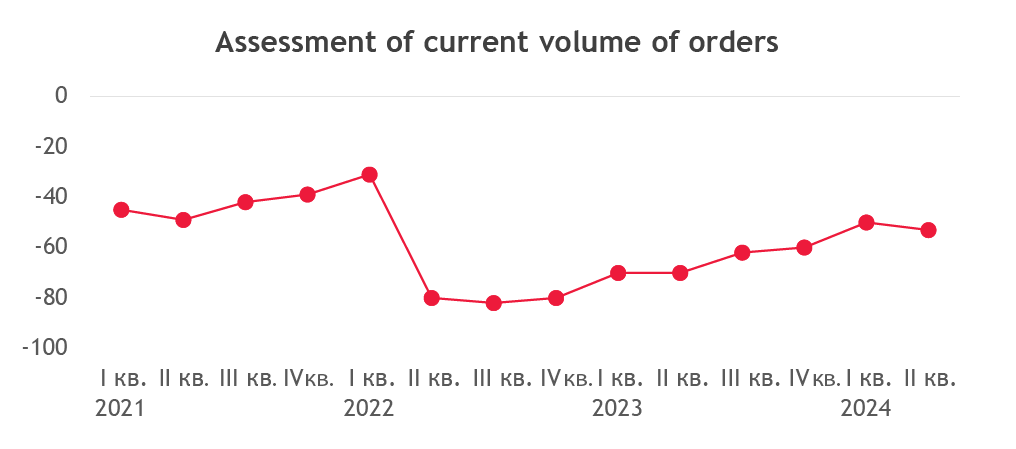

According to the State Statistics Service of Ukraine, the assessment of the shortage of current order volume deteriorated by 3 p.p. to minus 53%. 54% of the surveyed companies assessed their current order volume as insufficient, while 45% assessed it as normal for the season.

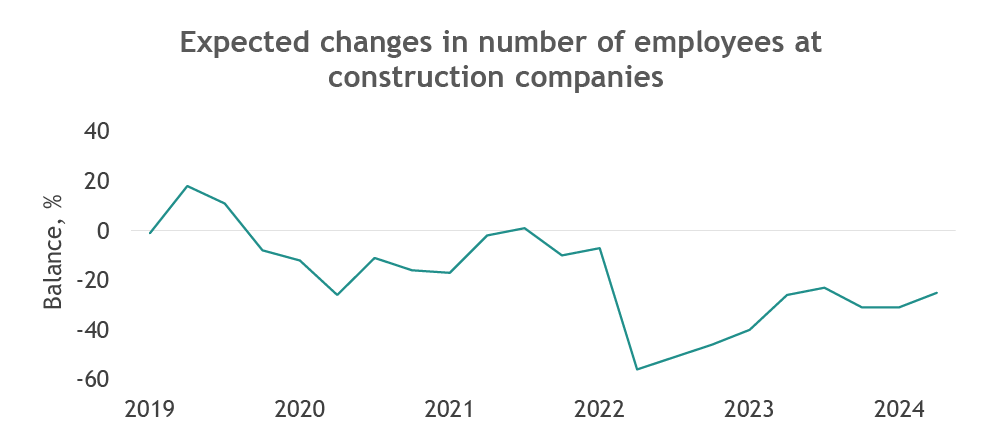

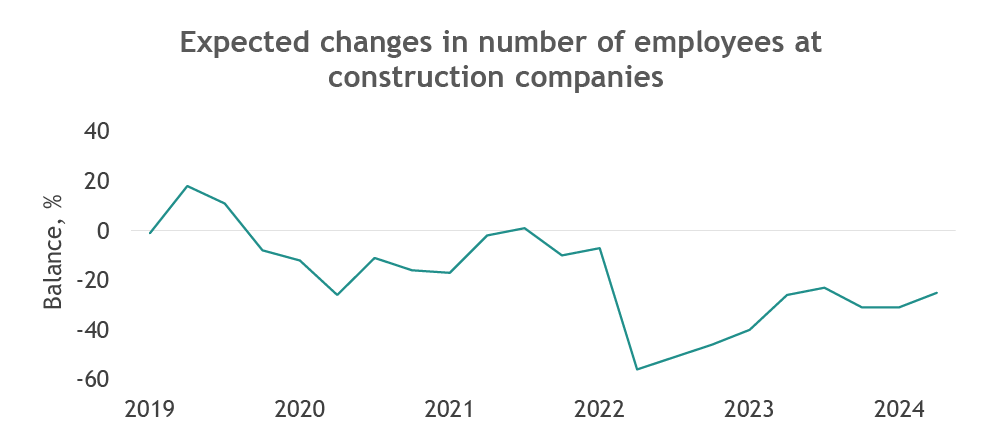

Among the main factors that negatively affect the number of workers on construction sites, respondents unanimously highlight mobilization. Expectations for changes in the number of employees in April-June 2024 are minus 31%.

There is a shortage of workers in almost all specialties. Experienced monolithic workers, electricians, plumbers, facade specialists and specialized construction equipment drivers are pure gold nowadays.

Mobilization in Ukraine is ongoing, and construction workers are often called up for military service.

Private construction companies can only book their workers if they are engaged in the reconstruction of housing, destroyed by the war, or are involved in the construction of critical infrastructure.

The long search for workers slows down construction and, along with higher wages, affects its cost. In addition, prices for construction materials are constantly rising. In some categories, the cost has increased by 30 to 200%. There are predictions that this year, when the labor shortage will become even more acute issue, developers may delay the commissioning of facilities. As a result, prices per square meter will rise significantly.

In 2024, Ukraine’s construction industry will be focused on restoring and modernizing infrastructure, developing residential and industrial construction. Despite economic challenges, the industry has significant potential for growth, especially with the support of the government and international partners. Innovations and efficient resource management will be key to the successful development of the construction industry.

The construction industry will face two challenges: a shortage of skilled labor and prices for construction materials that remain high due to global inflation and supply problems.

All of the above will affect the overall cost of construction projects, leading to an increase in real estate values and delay the timing of commissioning.

See more information or if you have questions, please contact us . We will be happy to provide the necessary advice.

The material was prepared by the specialists of the Construction and Real Estate industry group of BDO in Ukraine.

*Disclaimer: This information is general information and does not constitute professional advice or service. Before making any decision or taking any action that may affect your finances or operations, you should consult with a qualified professional advisor. Please contact BDO in Ukraine for advice.

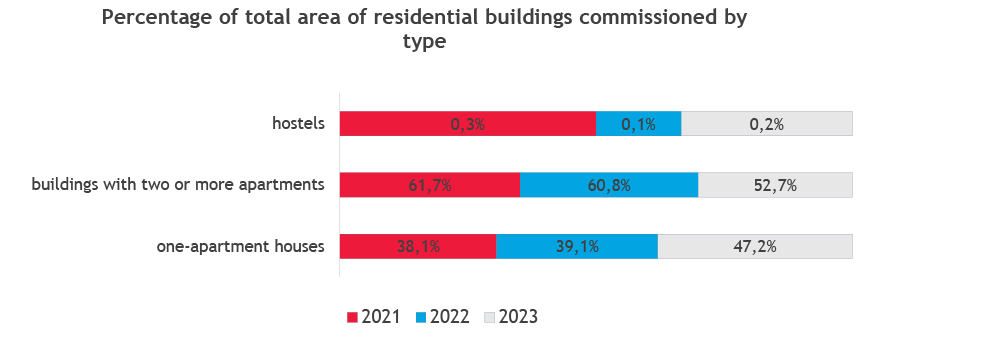

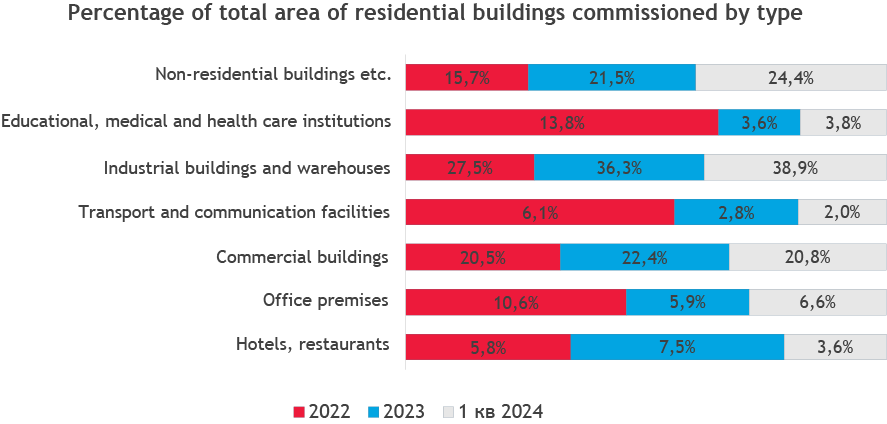

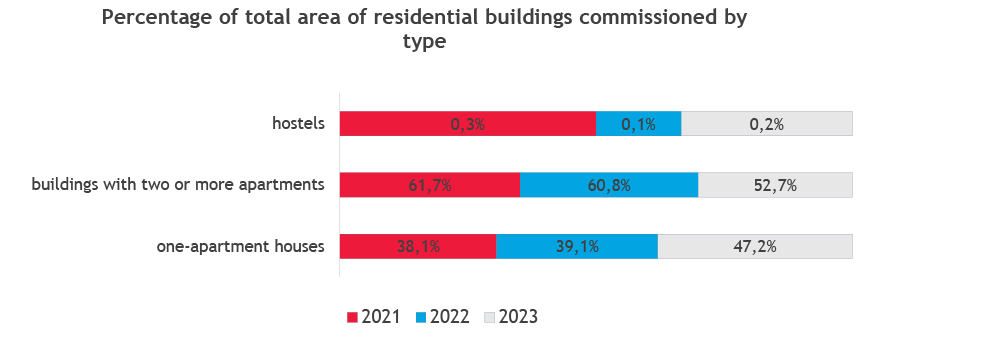

Data from the State Statistics Service of Ukraine. Data for 2024 are not disclosed to comply with the requirements of the Law of Ukraine “On Official Statistics” to ensure the guarantees of state statistics authorities regarding statistical confidentiality.

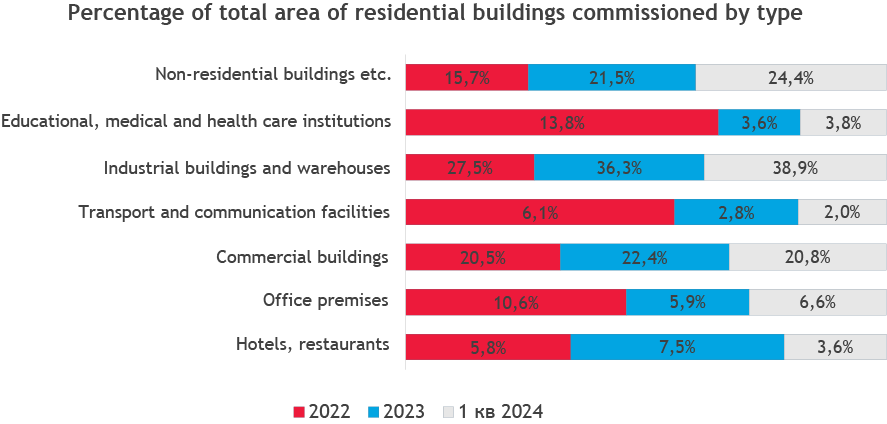

Data from the State Statistics Service of Ukraine.

The cost of residential real estate in regions far from the war zone has increased. The only exception is the capital, which has minimally reduced average prices since the end of the blackouts, in the spring of 2023. This is likely due to migration processes.

In terms of 1-room apartments, Kyiv lost 3% in price, while the price in Lviv increased by 12%. Ivano-Frankivsk became the record holder in terms of price increase of +18% in foreign currency.

In terms of two-rooms apartments: Vinnytsia demonstrated an increase of 18% in price, Ivano-Frankivsk — by 17%, Lviv — by 9%, and Kyiv demonstrated a price decrease of -1%.

Three-room apartments in the capital fell by 6%, in Vinnytsia and Ivano-Frankivsk they increased by 13%, and in Lviv they went up by 8% in foreign currency.

Absolute number of the most popular option among Ukrainians is 1-room apartments, the capital lost the most, where apartments fell by $2000 for an average. Prices increased the most in Lviv (+$6400), Ivano-Frankivsk (+$4700) and Chernihiv (+$4000), which is even ahead of Uzhhorod (+$3200).

Kyiv and Lviv have traditionally been the most expensive cities to buy a home in, but with the outbreak of full-scale war, Uzhhorod was added to the list, where you need to save a bit more than over 9 years of full average local salaries to buy an apartment.

Government programs as a stimulus to demand in the real estate market

The real estate market experienced a certain revival after the introduction of the state program “eOselya”. The program contributed to restore sales through affordable lending for certain categories of the population, providing mortgages at 3% per annum for servicemen of the Armed Forces of Ukraine, the Security Service of Ukraine, the Defence Intelligence of Ukraine, Ministry of Defence, doctors, scientists and teachers. Furthermore, according to the State Housing Agency, starting from 2023, the state has expanded the housing loan program to include: war veterans and their families, combatants, persons with disabilities as a result of the war, families of deceased war veterans as defined in Article 10 of the Law of Ukraine “On the Status of War Veterans, Guarantees of Their Social Protection”, as well as families of deceased defenders of Ukraine. internally displaced persons and other citizens, who do not own housing, or whose area is less than 52.5 m2 + 21 m2 for each additional family member.

According to Globus Bank, from October 1, 2022 to August of this year, the banks issued 2,898 loans under “eOselya” program totaling more than UAH 4 billion.

Apart from apartments, “eOselya” has also covered the purchase of private houses and townhouses. According to information from open information sources, namely: the number of offers for private houses on the OLX platform increased by 12% in the 1.5 months of the program’s operation with the coverage of the private houses, the number of reviews increased by 38%, and the average price rose slightly by just over 1%.

As for cottages, the situation is as follows: the number of ads for their sale increased by 6.3%, the number of responses increased by 37%, and the average price increased by 0.5%. The number of ads for townhouses has increased by just over 6% in the 1.5 months of the program’s operation, and the number of reviews from platform users has increased by 37%. At the same time, the average price increased by 1.5% compared to the end of January 2024.

Ads for the sale of a part of a house increased by more than 9%, the number of responses increased by 60%, and the average price increased by 11.6%.

As of mid-March, the first transactions for the purchase of houses through “eOselya” program have already been concluded. The program is currently being actively rolled out in the regions, and even certain categories have the opportunity to get a 0% interest rate. The development of “eOselya” has a positive impact on the demand for houses, townhouses and similar objects, and is one of the factors in the development of the real estate market as a whole. If financing is stable, public confidence in the program will grow (according to Ukrfinzhytlo, 5,855 housing loans worth UAH 8.85 billion were issued last year), which in turn will revive the market, increase the number of accredited developers for the program, new housing projects and create new jobs.

At the same time, the primary market is in a rather difficult situation, with demand remaining low and investment almost non-existent. Risks to the construction industry, both in terms of security and finance, remain significant. Therefore, we should not expect a dynamic recovery of this sector soon.

According to Globus Bank, from October 1, 2022 to August of this year, the banks issued 2,898 loans under “eOselya” program totaling more than UAH 4 billion.

Apart from apartments, “eOselya” has also covered the purchase of private houses and townhouses. According to information from open information sources, namely: the number of offers for private houses on the OLX platform increased by 12% in the 1.5 months of the program’s operation with the coverage of the private houses, the number of reviews increased by 38%, and the average price rose slightly by just over 1%.

As for cottages, the situation is as follows: the number of ads for their sale increased by 6.3%, the number of responses increased by 37%, and the average price increased by 0.5%. The number of ads for townhouses has increased by just over 6% in the 1.5 months of the program’s operation, and the number of reviews from platform users has increased by 37%. At the same time, the average price increased by 1.5% compared to the end of January 2024.

Ads for the sale of a part of a house increased by more than 9%, the number of responses increased by 60%, and the average price increased by 11.6%.

As of mid-March, the first transactions for the purchase of houses through “eOselya” program have already been concluded. The program is currently being actively rolled out in the regions, and even certain categories have the opportunity to get a 0% interest rate. The development of “eOselya” has a positive impact on the demand for houses, townhouses and similar objects, and is one of the factors in the development of the real estate market as a whole. If financing is stable, public confidence in the program will grow (according to Ukrfinzhytlo, 5,855 housing loans worth UAH 8.85 billion were issued last year), which in turn will revive the market, increase the number of accredited developers for the program, new housing projects and create new jobs.

At the same time, the primary market is in a rather difficult situation, with demand remaining low and investment almost non-existent. Risks to the construction industry, both in terms of security and finance, remain significant. Therefore, we should not expect a dynamic recovery of this sector soon.

Commercial real estate

Office real estate

In the face of military operations and a prolonged economic downturn, the office market in Kyiv has shown high resilience and adaptability.

The total volume of competitive office space remained unchanged at 2.22 million sq m since the beginning of the year. The average vacancy rate has stabilized at 25% (-1% YTD). Effective rents remained stable at an average of $20 per sq m per month (less of VAT and OPEX).

Despite the ongoing hostilities and the prolonged economic downturn, the office market in Kyiv in 2023 demonstrated significant resilience and adaptability. Most companies suspended staff reductions and actively sought ways to optimize real estate costs by renegotiating leases or modernizing and optimizing office space through relocation.

Tenant demand demonstrated signs of improvement, with annual gross absorption reaching approximately 91,000 sq m, a fourfold increase compared to 2022, but still 32% below the pre-war level of 2021. The structure of transactions was dominated by relocations (55%) and renegotiations of existing contracts (17%), while expansion of office space was relatively rare (6%). As in the previous year, there was a clear shortage of large transactions in 2023, with the maximum transaction size ranging from 1,500 to 3,000 sq m.

The war makes its own adjustments to everyday life and introduces new trends in the commercial real estate market. Some companies are staying in their offices, refusing to move to other locations, because the cost of relocation is significant, and companies are keeping their offices nominally, paying rent and related expenses, even though actual office use by the employees remains low, ranging from 15% to 50%.

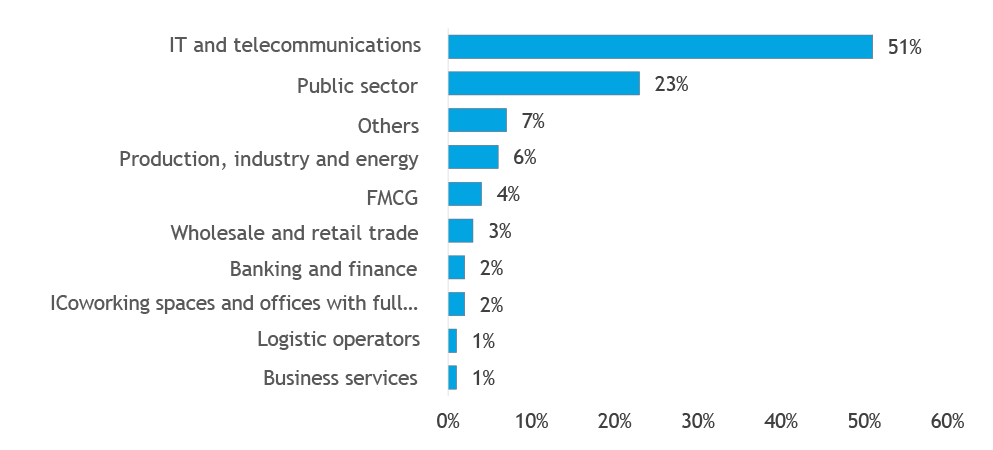

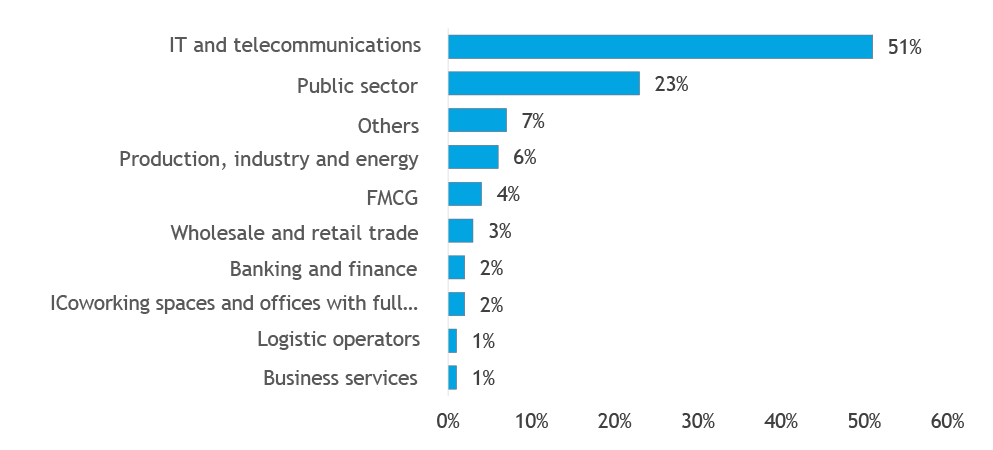

Demand by business sector shows that the IT and telecommunications sector continues to dominate (51%). However, the pace of development of this segment, which has historically been a key driver of demand and development of business centers, has slowed down due to the reduction in the physical presence of employees in offices. At the same time, the market did not see comparable demand for new offices from traditional industries such as pharmaceuticals, business and financial services, or the agricultural sector. The public sector, which accounted for 23% of total demand, remained active and is likely to remain so throughout 2024. Also, potential growth in demand may come from companies in the military-industrial complex, although their current share in the demand structure is insignificant.

The average vacancy rate remained relatively stable in 2023, decreasing by only 1% to 25% at the end of the year. Favorable lease conditions allowed companies to move from lower quality offices to better quality B and A properties at lower rental rates. The vacancy rate in class B was 27%, which was higher than in class A, where it was 24.7%, especially in lower quality buildings. The bulk of vacant premises was concentrated in newly built properties that have not yet reached high occupancy levels, as well as in lower quality buildings located mainly outside the central business district.

The average vacancy rate remained relatively stable in 2023, decreasing by only 1% to 25% at the end of the year. Favorable lease conditions allowed companies to move from lower quality offices to better quality B and A properties at lower rental rates. The vacancy rate in class B was 27%, which was higher than in class A, where it was 24.7%, especially in lower quality buildings. The bulk of vacant premises was concentrated in newly built properties that have not yet reached high occupancy levels, as well as in lower quality buildings located mainly outside the central business district.

The rental rate remained stable at $20 per square meter per month, down 5% since the beginning of the year. Transactions at this level of rents remain exceptional. The upper end of the requested rent in Class A decreased by 7% on average, ranging from $18 to $24 per sq m per month, while for Class B properties there was a significant decrease (-11%) and the range was $8-$16 per sq m per month.

The total volume of competitive office space remained unchanged at 2.22 million sq m since the beginning of the year. The average vacancy rate has stabilized at 25% (-1% YTD). Effective rents remained stable at an average of $20 per sq m per month (less of VAT and OPEX).

Despite the ongoing hostilities and the prolonged economic downturn, the office market in Kyiv in 2023 demonstrated significant resilience and adaptability. Most companies suspended staff reductions and actively sought ways to optimize real estate costs by renegotiating leases or modernizing and optimizing office space through relocation.

Tenant demand demonstrated signs of improvement, with annual gross absorption reaching approximately 91,000 sq m, a fourfold increase compared to 2022, but still 32% below the pre-war level of 2021. The structure of transactions was dominated by relocations (55%) and renegotiations of existing contracts (17%), while expansion of office space was relatively rare (6%). As in the previous year, there was a clear shortage of large transactions in 2023, with the maximum transaction size ranging from 1,500 to 3,000 sq m.

The war makes its own adjustments to everyday life and introduces new trends in the commercial real estate market. Some companies are staying in their offices, refusing to move to other locations, because the cost of relocation is significant, and companies are keeping their offices nominally, paying rent and related expenses, even though actual office use by the employees remains low, ranging from 15% to 50%.

Demand by business sector shows that the IT and telecommunications sector continues to dominate (51%). However, the pace of development of this segment, which has historically been a key driver of demand and development of business centers, has slowed down due to the reduction in the physical presence of employees in offices. At the same time, the market did not see comparable demand for new offices from traditional industries such as pharmaceuticals, business and financial services, or the agricultural sector. The public sector, which accounted for 23% of total demand, remained active and is likely to remain so throughout 2024. Also, potential growth in demand may come from companies in the military-industrial complex, although their current share in the demand structure is insignificant.

The average vacancy rate remained relatively stable in 2023, decreasing by only 1% to 25% at the end of the year. Favorable lease conditions allowed companies to move from lower quality offices to better quality B and A properties at lower rental rates. The vacancy rate in class B was 27%, which was higher than in class A, where it was 24.7%, especially in lower quality buildings. The bulk of vacant premises was concentrated in newly built properties that have not yet reached high occupancy levels, as well as in lower quality buildings located mainly outside the central business district.

The average vacancy rate remained relatively stable in 2023, decreasing by only 1% to 25% at the end of the year. Favorable lease conditions allowed companies to move from lower quality offices to better quality B and A properties at lower rental rates. The vacancy rate in class B was 27%, which was higher than in class A, where it was 24.7%, especially in lower quality buildings. The bulk of vacant premises was concentrated in newly built properties that have not yet reached high occupancy levels, as well as in lower quality buildings located mainly outside the central business district. The rental rate remained stable at $20 per square meter per month, down 5% since the beginning of the year. Transactions at this level of rents remain exceptional. The upper end of the requested rent in Class A decreased by 7% on average, ranging from $18 to $24 per sq m per month, while for Class B properties there was a significant decrease (-11%) and the range was $8-$16 per sq m per month.

Warehouse real estate

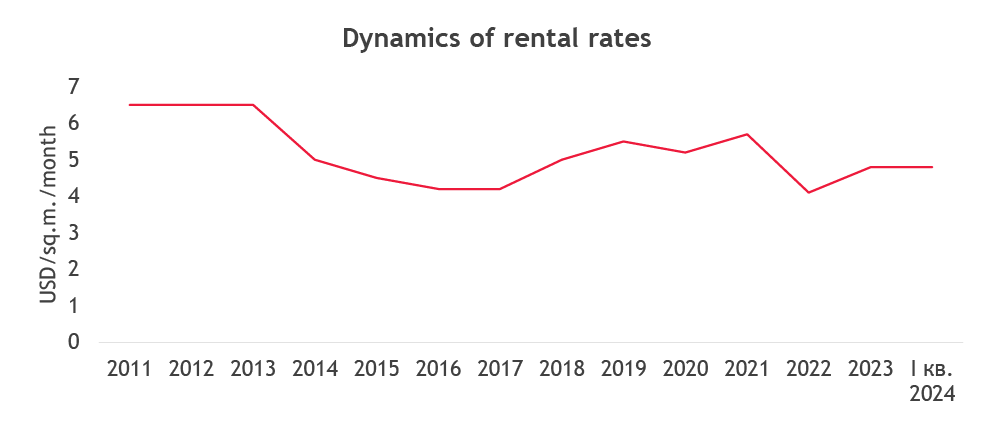

In the first quarter of 2024, the warehousing property market remained stable with no significant changes. Leasing activity continued to be limited, however, several large tenants were conducting market research with a view to expansion.

The wholesale and retail sector continued to dominate the leasing activity, with a slight increase in the share of healthcare and pharmaceuticals. Total quarterly gross absorption amounted to approximately 23,000 square meters, which corresponds to a decrease of 21% year-on-year.

During the first quarter of 2024, no new properties were brought to the market.

Due to the lack of new supply and the existing shortage of available space, the vacancy rate remained at 1.8% at the end of Q1 2024.

Rental yields in US dollar terms have been improved and amounted to $4.9 per sq m per month (less VAT and operating expenses) for quality warehousing space.

The wholesale and retail sector continued to dominate the leasing activity, with a slight increase in the share of healthcare and pharmaceuticals. Total quarterly gross absorption amounted to approximately 23,000 square meters, which corresponds to a decrease of 21% year-on-year.

During the first quarter of 2024, no new properties were brought to the market.

Due to the lack of new supply and the existing shortage of available space, the vacancy rate remained at 1.8% at the end of Q1 2024.

Rental yields in US dollar terms have been improved and amounted to $4.9 per sq m per month (less VAT and operating expenses) for quality warehousing space.

Business expectations of developers for 2024

Business expectations of developers for 2024

Businesses improved their expectations for business activity over the next 12 months. Despite security risks and logistical difficulties, including problems with border crossings, respondents forecast moderate growth in production of goods and services and were positive about the development of their businesses. Inflation expectations continued to improve, while currency expectations deteriorated slightly.In the second quarter of 2024, the indicator of business confidence in construction decreased by 1.1 points compared to the first quarter of 2024 and amounts 40.9%.

According to the State Statistics Service of Ukraine, the assessment of the shortage of current order volume deteriorated by 3 p.p. to minus 53%. 54% of the surveyed companies assessed their current order volume as insufficient, while 45% assessed it as normal for the season.

Among the main factors that negatively affect the number of workers on construction sites, respondents unanimously highlight mobilization. Expectations for changes in the number of employees in April-June 2024 are minus 31%.

There is a shortage of workers in almost all specialties. Experienced monolithic workers, electricians, plumbers, facade specialists and specialized construction equipment drivers are pure gold nowadays.

Mobilization in Ukraine is ongoing, and construction workers are often called up for military service.

Private construction companies can only book their workers if they are engaged in the reconstruction of housing, destroyed by the war, or are involved in the construction of critical infrastructure.

The long search for workers slows down construction and, along with higher wages, affects its cost. In addition, prices for construction materials are constantly rising. In some categories, the cost has increased by 30 to 200%. There are predictions that this year, when the labor shortage will become even more acute issue, developers may delay the commissioning of facilities. As a result, prices per square meter will rise significantly.

Recap

In 2024, Ukraine’s construction industry will be focused on restoring and modernizing infrastructure, developing residential and industrial construction. Despite economic challenges, the industry has significant potential for growth, especially with the support of the government and international partners. Innovations and efficient resource management will be key to the successful development of the construction industry.The construction industry will face two challenges: a shortage of skilled labor and prices for construction materials that remain high due to global inflation and supply problems.

All of the above will affect the overall cost of construction projects, leading to an increase in real estate values and delay the timing of commissioning.

See more information or if you have questions, please contact us . We will be happy to provide the necessary advice.

The material was prepared by the specialists of the Construction and Real Estate industry group of BDO in Ukraine.

*Disclaimer: This information is general information and does not constitute professional advice or service. Before making any decision or taking any action that may affect your finances or operations, you should consult with a qualified professional advisor. Please contact BDO in Ukraine for advice.