BDO in Ukraine continues to open the Ukrainian market to the international community. On 11 June 2025, we conducted a webinar for Scottish companies on the business opportunities available in Ukraine. The event was organised in cooperation with the Cross-Party Group on Ukraine (Business and Economy Working Group), the Scottish Government and the Nazovni Platform, with support from the Consulate of Ukraine in Edinburgh, the Scottish Enterprise and the Glasgow Chamber of Commerce. The event highlighted key opportunities for Scottish companies to engage in Ukraine’s recovery and reconstruction.

The event was moderated by Yuliya Melnyk, Head of the UK Chapter, Global Business for Ukraine, who guided the discussion and addressed key challenges for Scottish businesses, fostering a dynamic exchange of insights between participants and speakers.

The webinar focused on the significant potential for collaboration between Ukraine and Scotland, particularly in sectors such as infrastructure, IT, green energy and agriculture. Participants were encouraged to explore how they could contribute to Ukraine’s rebuilding process while benefiting from the growth opportunities the country offers.

The recent signing of a Memorandum of Understanding between the Scottish Government and the Ministry of Foreign Affairs of Ukraine, which occurred very recently on the 28th of May, paving the way for a mutually beneficial partnership based on innovation and long-term strategic goals. The cooperation aims to support Ukraine’s recovery while fostering economic growth for both nations.

Scott Strain, Head of Export Promotion Policy at the Scottish Government, noted, “The signing of the Memorandum of Understanding with the Ukrainian government provides a solid framework to advance our future relationships with Ukraine. We have recently updated our export strategy, adding Ukraine as a special interest market. This allows Scottish Development International to work more proactively with Scottish companies exploring opportunities in Ukraine. We are also collaborating closely with the UK Government’s Department for Business and Trade, having a presence in both Ukraine and Poland, as well as UK Export Finance, which can provide insurance and guarantees for the companies looking to export to Ukraine.”

“Our main focus is on strengthening economic ties between our nations by supporting business aspirations of the displaced Ukrainian community in Scotland, facilitating the entry of Ukrainian businesses to the Scottish market, and reciprocally supporting Scottish businesses seeking opportunities in Ukraine. This also aligns with our commitment to supporting Ukraine’s recovery efforts,” stated Anna Kulish, Chair of the Business and Economy Working Group, Cross-Party Group on Ukraine.

Viktoriia Savchuk, Senior Manager of the Export-Import Support Department at the NAZOVNI Platform, highlighted the platform’s pivotal role in Ukraine’s long-term strategy to attract reliable international partners. “NAZOVNI is a government-backed initiative supported by the Ministry of Foreign Affairs of Ukraine, designed to connect foreign businesses with verified Ukrainian companies,” she explained. With over 5,500 international contracts facilitated and almost 3,000 Ukrainian firms registered, the platform has proven to be a practical and effective tool for fostering cross-border cooperation. Viktoriia emphasised that NAZOVNI offers Scottish companies a direct, secure channel into one of Europe’s most dynamic markets, particularly in sectors such as infrastructure, green energy, digitalisation, agritech and education, where Ukrainian opportunities align with Scottish innovation.

What is the current situation in Ukraine?

As we continue to navigate the complexities of the ongoing war, there are four key aspects that define the current situation in Ukraine: the frontline, infrastructure recovery, the economy and international aid.1. Frontline

Ukraine’s defence is holding strong, aided by the strategic use of FPV drones. Although russian forces are attempting to advance in the Dnipro and Sumy regions, the frontline remains relatively stable. While there are ongoing discussions regarding a potential ceasefire, the likelihood of achieving sustainable peace appears uncertain until 2025, given russia’s economic and military pressures.

2. InfrastructureUkraine is making steady progress in the reconstruction of its damaged infrastructure. As of early 2025, over 247,000 homes have been damaged or destroyed, with about 30% of them having been restored. In the education and healthcare sectors, 4,000 institutions and 2,285 healthcare facilities have been affected, with a significant number restored. However, a substantial funding gap remains, with an estimated $17.3 billion required for 2025 recovery, of which only $7.4 billion has been funded to date. The most significant gaps are in the areas of energy, housing, and transport, which continue to pose significant challenges to the recovery process.

3. EconomyAs of June 2025, the Ukrainian economy remains under significant strain from the ongoing war, with the National Bank revising its GDP growth forecast downward to 3.1% due to infrastructure damage, labour shortages resulting from mobilisation and emigration. Inflation is forecasted to decline from 12% to 8.7%, while foreign reserves have reached a record $43.8 billion — providing the central bank with the flexibility to gradually lift currency restrictions, a move that is expected to benefit foreign investors. Despite the introduction of a 50% windfall tax on profits in 2023, the banking sector continues to generate substantial profits.

As Andrii Borenkov, Head of Advisory at BDO in Ukraine explained, “The Ukrainian budget is still a war budget. Around half of the state budget is spent on defence — this half is financed by Ukrainian taxpayers, while the second, “civil” portion is covered by donors. We estimate that defence spending will exceed 30% of GDP by 2027, compared to 2–5% for NATO countries.”

4. International aid

Ukraine’s recovery and ongoing economic stability are heavily supported by international aid. In 2024, total international aid received by Ukraine reached $41.6 billion, with the European Union, the IMF, and the United States being the top contributors. This aid is essential for covering Ukraine’s budget deficit and ensuring macroeconomic stability. Without this support, Ukraine would face a fiscal gap of 32.5% of GDP. Discussions are ongoing regarding the financing of Ukraine’s military budget, including the possibility of transferring some military expenses to international donors, which could reduce the financial burden on Ukrainian taxpayers.

In conclusion, although Ukraine is facing significant challenges, its resilience in terms of defence, recovery efforts and the economy, supported by international aid, offers hope for recovery. The situation remains dynamic, with the potential for a turning point in 2025.

Business opportunities for Scottish companies in Ukraine

Ukraine offers Scottish investors and businesses significant opportunities across diverse industries. Ukraine’s geographical location at the heart of Europe and its role as a strategic bridge between the East and the West provide access to over 500 million consumers through its own market and preferential trade with the EU. Key industries presenting opportunities include:

- Agribusiness: Blessed with 30% of the world’s black soil and extensive farmlands, Ukraine remains a global agricultural powerhouse. It is a leading exporter of grains and sunflower oil, and is modernising food processing and irrigation systems. Scottish agritech firms and food producers could collaborate with Ukrainian partners in farming, processing and boosting food security, capitalising on Ukraine’s fertile land and need for agricultural innovation.

- Natural resources: Ukraine boasts significant deposits of critical minerals such as lithium, titanium, uranium and iron ore. These resources are in demand in industries such as electronics, renewable energy and aerospace. Scottish companies specialising in mining, engineering and raw material processing could invest in or provide technology to access these reserves under transparent, mutually beneficial ventures.

- Information Technology: Ukraine is home to one of Europe’s largest IT talent pools. A high standard of engineering education and supportive policies (such as special tax regimes for tech companies — Diia.City), have established Ukraine as a major player in the global IT outsourcing services market. This thriving digital sector offers opportunities for collaboration in software development, cybersecurity, fintech and innovations in the defence industry.

- Energy & Renewables: Ukraine is accelerating its green transition. There is vast potential in solar and wind energy, with plans in place for the development of hydrogen fuel. Investments in wind farms, solar parks and bioenergy are backed by government programmes that align with EU green policies. Scottish energy companies with extensive experience in renewable energy can invest in or export technology to Ukrainian projects. Furthermore, the rebuilding of energy infrastructure (following war damage) means demand for modern grids, energy storage and efficiency solutions.

- Infrastructure & Construction: The destruction caused by the war has created an enormous need to rebuild homes, roads, bridges and factories. Ukraine is insisting on a “Build Back Better” approach, which involves rebuilding with modern, resilient designs. This creates opportunities for construction firms and suppliers of building materials. Scottish companies specialising in engineering, architecture and construction could contribute their expertise to housing projects, urban development and the modernisation of logistics networks (such as railways, seaports, highways). Those who enter the market early will gain experience and build a reputation as Ukraine’s recovery progresses.

Favourable UK–Ukraine agreements bolster these opportunities. The UK–Ukraine Free Trade Agreement grants virtually tariff-free trade, simplifying the export and import of goods. A cutting-edge Digital Trade Agreement ensures open digital markets and data flow, facilitating e-commerce and tech partnerships. Joint initiatives such as the UK–Ukraine TechBridge connect British and Ukrainian tech companies, while a landmark 100-Year Partnership Agreement between the two countries underscores long-term cooperation in defence, energy and economic development. These accords foster a business-friendly environment that encourages Scottish enterprises to do business in Ukraine.

“We need to find ways to collaborate because Ukraine cannot rely on support and aid forever – in mutually beneficial collaboration, both our nations can prosper,” said Vira Savchenko, CEO of BDO in Ukraine and Co-chair of the Ukraine Recovery Committee at the European Business Association, emphasising a shift from aid to partnership. Her sentiment underlines that beyond immediate aid, Scottish businesses an opportunity to establish profitable ventures while helping Ukraine rebuild.

Ukraine’s Recovery initiatives

Ukraine’s recovery is not merely a reconstruction project — it is a comprehensive reinvention based on the principle of Build Back Better. According to the latest Fourth Rapid Damage and Needs Assessment (RDNA4), the country requires over $524 billion to fully recover, with the most urgent requirements relating to housing, transport, energy and commerce. This extensive reconstruction agenda involves multiple levels: the national government, local municipalities and the private sector — each offering distinct engagement opportunities for foreign partners, including Scottish enterprises.At the state level, Ukraine is collaborating with donors and international financial institutions to rebuild critical infrastructure and public services. The DREAM platform, coordinated by the Ministry for Restoration and Agency for Restoration, centralises data and project management to ensure the efficient and transparent deployment of recovery funds. At the municipal level, over 1,000 communities are developing their own reconstruction plans, facilitating decentralised collaboration.

Recognising that government aid alone cannot cover the cost of reconstruction, Ukraine is actively involving the private sector. Local firms are seeking foreign partners to establish joint ventures in manufacturing, energy, and construction. Updated procurement laws and the Prozorro e-procurement system ensure that tenders are open and competitive, enabling Scottish construction companies to bid on a road-building project funded by the Ukrainian government or IFIs on an equal footing with others.

Additionally, the government and international partners have developed investment-stimulating mechanisms, including the €50 billion Ukraine Facility programme which runs until 2027 and supports private businesses through grants, loans and guarantees. Financial instruments from development banks, risk insurance options and local funding initiatives are available to mitigate risk and attract investment, particularly in regions with a moderate or low risk profile, such as Lviv, Ivano-Frankivsk and Zakarpattia.

International collaboration is central to Ukraine’s recovery. Platforms such as NAZOVNI (run by Ukraine’s Ministry of Foreign Affairs) connect foreign businesses with vetted local partners, facilitating entry. The Investment Opportunities Map, developed by the European Business Association and UkraineInvest, lists ready-to-invest projects by industry and region. Additionally, practical guides (for example, the Investor’s guide to Ukraine’s Reconstruction or the Guide on how to navigate Ukrainian public tenders, developed by the BDO in Ukraine experts) are available to support newcomers. All of these resources lower the barriers to entry for Scottish enterprises looking to engage in reconstruction.

Ukraine’s recovery presents a generational opportunity — not only to repair the damage caused, but also to design and build a modern, sustainable, and inclusive nation. As Vira Savchenko reminded the international audience, “The first to invest in Ukraine will benefit the most. The risks are real, but with the right platforms, partnerships and policies, they can be managed — and the benefits are tangible.”

Peculiarities of doing business in Ukraine during the war

The ongoing war in Ukraine has catalysed significant changes to the legal landscape, directly impacting business operations. To support the economy and incentivise investment during this difficult period, the government has introduced various legal adjustments. Martial law, which has been in effect since 24 February 2022 and extended quarterly, introduced a specific legal regime with heavy restrictions as well as support measures. The government’s strategy balances defence needs (such as preventing capital flight) with economic support (tax cuts, simplified rules) in an unprecedented environment.

Viacheslav Petrashenko, a senior lawyer at BDO in Ukraine, observed: “When the war started, the government immediately introduced restrictions on currency conversion, dividend repatriation and loan repayments leaving Ukraine. But at the same time they introduced huge tax advantages to stimulate business. For example, in 2022 we had a mere 2% turnover tax for small companies. The concept now is “new money, new rules”: new investors can repatriate dividends (up to €1 million per month from 2024), while old investors are still waiting to repatriate their earlier profits.”

Similarly, shareholder loans made before the war cannot yet be repaid (interest payments are limited), whereas new loans (after June 2023) can be serviced with certain restrictions. Also, set-offs between local firms and foreign partners are disallowed to keep money flowing into Ukraine. The existing 183-day rule is being strictly enforced: exporters must receive payment within 183 days and importers must receive goods within 183 days of making an advance payment, otherwise they will face a steep daily penalty of 0.3% on overdue amounts.

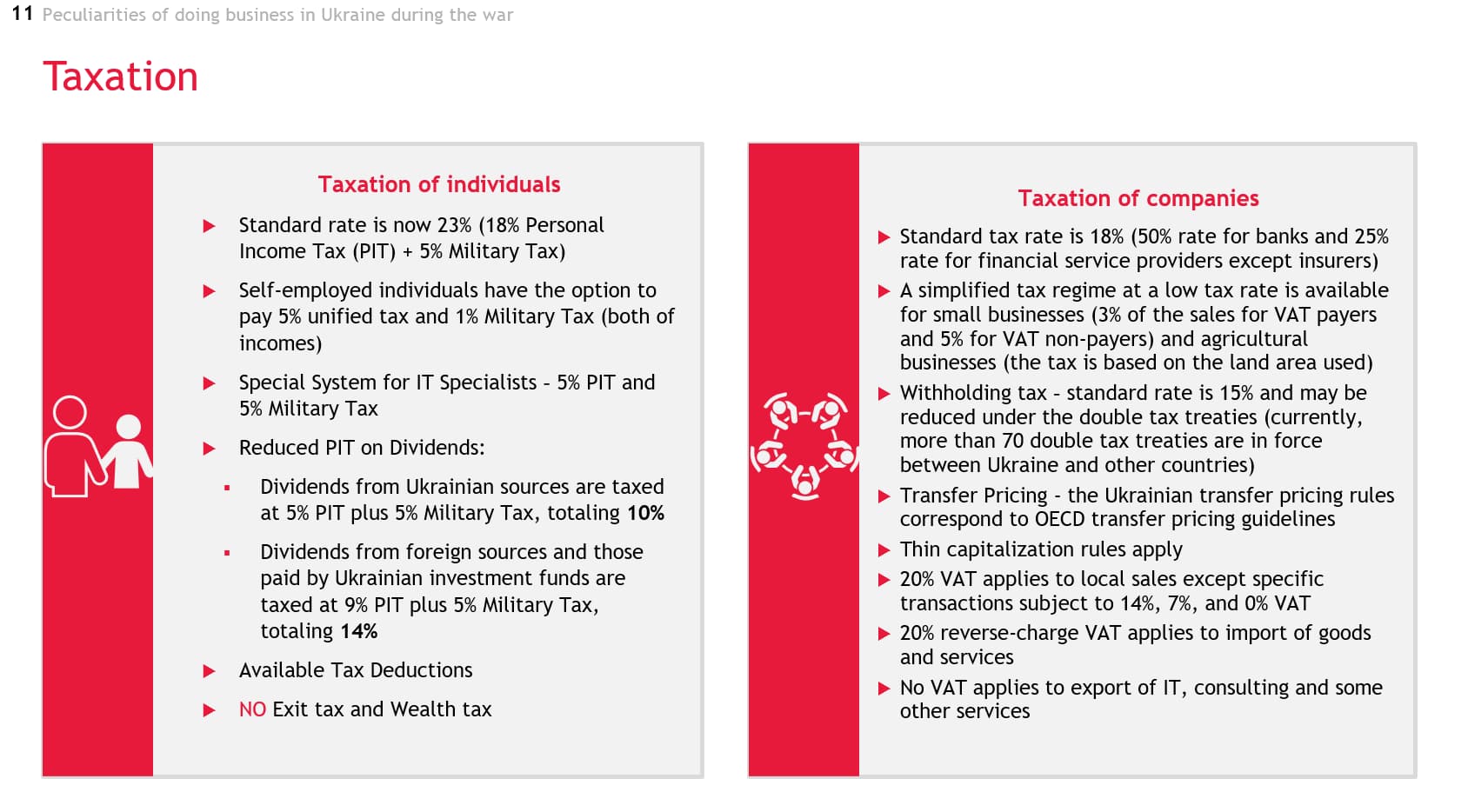

In addition to currency control measures, Ukraine introduced several tax incentives to stimulate the economy during the war. A key reform was the reduction of turnover tax for small businesses from 5% to 2%, benefiting many enterprises and promoting business activity. However, as the government moves towards stabilisation, some of these tax benefits are being phased out. For instance, the VAT exemption for solar panels, intended to support the renewable energy sector, is set to expire in 2024. Meanwhile, personal income taxes have increased slightly, with a 5% military tax surcharge to support defence spending.

One of the notable measures introduced before and during the war was the Diia.City special tax regime for the IT sector. Designed to attract tech investments, this initiative offers significant tax breaks, including a reduced personal income tax rate of 5% compared to the general rate of 18%. The corporate tax rate for Diia.City residents is also appealingly low at 9%. The regime provides tech companies with a unique opportunity to operate efficiently in Ukraine, where they can benefit from a stable legal framework guaranteed for 25 years.

Significant labour and operational challenges arise under martial law. General mobilisation means that most Ukrainian men aged 25–60 are subject to conscription, resulting in labour shortages. Employers are not required to pay salaries to mobilised employees (the positions must be held for them, but wage payments can be suspended). However, there are categories eligible for deferment: for instance, men supporting three or more children, certain students, or those with health issues are not taken into service immediately. Most importantly, businesses classified as “critical infrastructure companies” can exempt up to 50% of their male employees from the draft if they meet the criteria.

Despite the war, it is still very much possible to start and run a business in Ukraine. Company registration procedures have been streamlined, and it is now possible to register a new Limited Liability Company (LLC) remotely in a matter of days. The law requires full disclosure of ultimate beneficial owners (UBOs) for any new entity, a transparency measure aimed at preventing sanctioned individuals (e.g., Russian or Belarusian owners) from hiding behind shell companies. Basic steps such as opening bank accounts and obtaining the necessary licenses or permits for regulated sectors (finance, energy, etc.) remain in place, but many bureaucratic hurdles have been temporarily lifted to encourage entrepreneurship. For example, certain inspections have been postponed and some permit processes expedited under martial law. Staff employment is also flexible: businesses can hire via standard labour contracts or civil contracts for contractors, and Diia.City companies can use special “gig contracts” for IT specialists. When hiring foreign nationals, work permits are still required in most cases, though critical skill exemptions may apply.

Despite the ongoing war, Ukraine is creating a favourable business environment by offering attractive legal and financial incentives for foreign investors. This approach aims to support the economy’s immediate needs while also positioning Ukraine as a future investment hub.

Government support for foreign investment in Ukraine

Ukraine’s Export Credit Agency (ECA) is now offering war and political risk insurance to encourage foreign investors to fund projects in Ukraine. In 2024, the ECA launched two new insurance products, both of which have the clear mission of making investing in Ukraine safe and attractive despite the war. The first product covers investment loans provided by Ukrainian banks to companies for new projects, while the second covers a foreign or local investor’s direct equity in a Ukrainian business. In both cases, the ECA promises to compensate for any losses resulting from extraordinary events such as war, terrorism, expropriation, or government payment moratoria. By providing coverage for such extreme risks, which are typically beyond the scope of ordinary insurers, the ECA effectively mitigates the foreign direct investment risks in Ukraine, enabling projects to proceed even under volatile conditions.There are unprecedented opportunities for international investors. ECA’s insurance can protect any investor, Ukrainian or foreign, investing in export-oriented facilities in Ukraine. “We can cover an investment even if it is really close to the front line, because one of the risks we cover is the risk of occupation,” explains ECA Deputy CEO Oksana Ocheretiana, emphasising that ECA imposes no geographic exclusions for conflict zones.

In practical terms, a foreign company building a factory in Ukraine can rest assured that, even in a worst-case scenario (like renewed fighting or political upheaval), their capital is safeguarded by a state-backed guarantee. Given the risks, the cost of coverage is relatively modest: for example, ECA insured a ₴9 million (approx. USD 0.22 million) equipment loan for a manufacturing firm at an annual premium of only 0.9%. Similarly, a ₴40 million (approx. USD 0.96 million) expansion loan for a food processing exporter was insured against war risks at 1.62% per year. These initial results demonstrate that affordable insurance can render high-risk projects financially viable: banks were willing to lend, and companies were able to expand production, specifically because ECA absorbed the war-related risk.

Oksana Ocheretiana added: “Our goal is to encourage investment in Ukraine by providing a safety net for investors, particularly during times of instability. By offering insurance products, we can help secure the financial future of those investing in manufacturing and export. We’ve seen significant interest from both foreign and domestic entities in these products, and we continue to improve them by learning from international best practices.”

To sum up, ECA’s investment insurance opens the door for foreign investors to seize business opportunities in Ukraine’s promising sectors (manufacturing, agribusiness, IT and energy) without having to wait for complete stability. It transforms Ukraine from a perceived “no-go” zone into an attractive emerging market, where the Ukrainian government’s commitment shields investors’ assets against worst-case scenarios. This programme not only protects investors but also fuels Ukraine’s economic resilience: every insured investment helps to build factories, create jobs and boost exports, linking foreign success to Ukraine’s recovery in a truly symbiotic way.

Overcoming challenges and seizing opportunities: the experience of Scottish company Cairnhill Structures

Cairnhill Structures, a Scotland-based engineering services company, has been actively involved in the reconstruction of critical infrastructure in Ukraine. The firm is rebuilding three bridges in the Kyiv region – notably the Vishgorod and Makarov bridges – which were demolished by Ukrainian forces in 2022 to impede the russian advance. The company’s involvement began in early 2023, when the UK government offered export finance guarantees to support UK contributions to the project. This initiative was part of a broader effort to assist Ukraine in reconstructing critical infrastructure destroyed during the war.Paul Denning, a Group Service Director at Cairnhill Structures, described the significance of this venture: “It’s been a fantastic journey. It’s taken me two years from initially identifying the opportunity to actually cutting steel, so it’s been a very long process. But it’s fair to say it remains a fantastic opportunity for the business. It’s created a huge amount of interest, not just externally – people are excited that we’re delivering something for Ukraine – but also internally. Our team really feels that they are contributing to society by building two bridges that will significantly improve the lives of locals in the Kyiv area”.

The bridges in Vishgorod and Makariv are of particular importance due to their strategic location and the critical role they play in local transportation. Originally built from concrete, the bridges are being rebuilt using steel that meets Ukrainian engineering standards to ensure they can withstand the harsh winter conditions. The project is expected to be completed by September 2025, with ongoing support from Cairnhill Structures.

Although the challenges of working in Ukraine are significant, Cairnhill has shown remarkable resilience. Despite the slow pace of government approvals and financial authorisations, the company has successfully overcome these hurdles. Its expertise in steel fabrication, as well as the experience in providing temporary and permanent structural solutions have established Cairnhill as a key player in the ongoing reconstruction efforts.

Looking ahead, Cairnhill foresees more opportunities for UK companies to contribute to Ukraine’s reconstruction efforts. “There are hundreds of bridges that need to be rebuilt in Ukraine,” says Paul. “While not all of them will be projects for Cairnhill, we are actively seeking more opportunities and engaging with the UK government to extend their support for additional infrastructure projects. The recent policy shift by the UK government shows promise, and we are excited about what lies ahead.”

The company’s success in Ukraine exemplifies the potential for UK firms to have a significant impact through engineering expertise and international collaboration. Cairnhill Structures is continuing to explore new projects in Ukraine, with a focus addressing critical infrastructure gaps and supporting the country’s long-term recovery.

As Ukraine continues to rebuild and recover, there are substantial and timely opportunities for international businesses. With the country’s strategic importance, attractive investment sectors, and supportive frameworks, foreign companies have a clear and reliable path for collaboration. BDO in Ukraine is ready to help businesses navigate this promising landscape, providing expert advice on investment opportunities, forming strategic partnerships, and complying with Ukraine’s evolving regulatory environment. Contact us for more details.