Anastasiia Skok

| Standard | Description | Mandatory | Coverage |

|---|---|---|---|

| ESRS | European reporting standards | Yes | EU |

| GRI | Global reporting standards | No | International |

| Benefit | Description |

|---|---|

| Attracting investment | Enhancing investment attractiveness |

| Reputation improvement | Demonstrating social responsibility |

| Risk reduction | Identifying and minimizing ESG-related risks |

“Sustainability is not just a trend, it’s a strategic necessity for every business. Implementing ESG principles enables companies to stay competitive, reduce risks, and create value for all stakeholders.” — Anastasiia Skok, Head of ESG department at BDO in Ukraine.

Frequently Asked Questions (FAQ) about Sustainable Development (ESG)

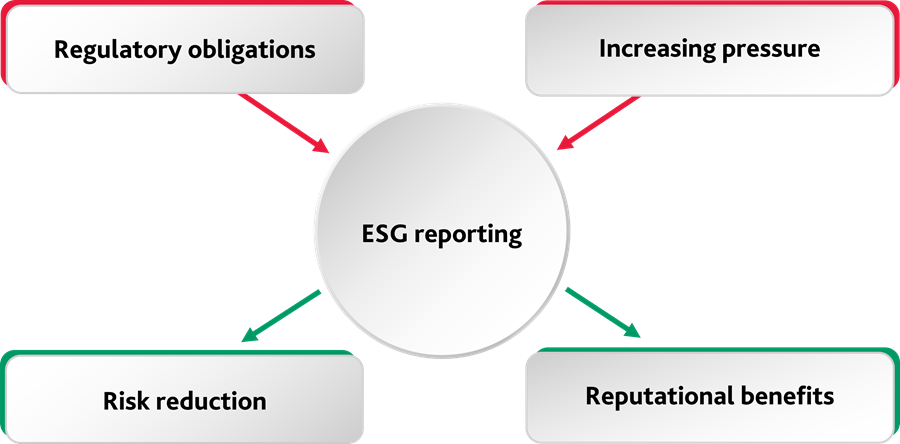

ESG (Environmental, Social, Governance) refers to the criteria used to assess a company’s environmental, social and governance practices. Implementing ESG approaches can help to reduce risks, attract investment and improve your company’s reputation.

We assess your company’s current state, develop a bespoke strategy, integrate ESG principles into your business processes and provide support throughout the implementation process.

We work with international standards such as ESRS, CSRD, and GRI to ensure compliance with the latest sustainability best practices.

We help small businesses develop and implement ESG strategies that are tailored to their specific needs. This involves assessing the current situation, identifying priorities and creating a customised ESG implementation plan that aligns with international standards and Ukrainian legislation.

CSRD (Corporate Sustainability Reporting Directive) is an EU directive that requires companies to report on their social, environmental and governance practices. It affects all businesses working with European partners or holding international investments. For Ukrainian companies cooperating with the EU, CSRD compliance will become mandatory, requiring transparency in matters of sustainability, the environment, and social responsibility.

Yes. We consider the unique environmental, social and economic conditions of each region, as well as local legal requirements. We adapt ESG strategies for Ukrainian enterprises based on global standards (e.g. GRI and CSRD) and national regulations and market specifics.

We develop comprehensive ESG strategies for large companies, covering all aspects of sustainability, including environmental initiatives, social responsibility, corporate governance and effective risk management. We collaborate with senior management to integrate ESG principles into the company’s culture and guarantee adherence to international reporting standards.

Glossary

AI for ESG — the use of artificial intelligence for ESG data analysis, reporting automation, and risk assessment.

Anchor regulation — key regulatory frameworks (such as the CSRD or the EU Taxonomy) that establish ESG reporting requirements.

Clawback in ESG — a mechanism for reclaiming bonuses or incentives from managers if ESG targets are not met.

Corporate reporting — a company’s system of financial and non-financial disclosures for investors, regulators and other stakeholders.

CSRD (Corporate Sustainability Reporting Directive) — the EU directive that sets mandatory sustainability reporting requirements for large companies and SMEs.

Deferral of reporting — the possibility for companies to postpone ESG reporting during adaptation to new standards.

Double materiality — a concept requiring companies to assess both the impact of ESG factors on their business and the impact of their business on the environment and society.

ESG (Environmental Social Governance) — a framework for evaluating companies based on sustainability and responsible business practices. It is used by investors, banks, and regulators in decision-making.

ESG disclosure — the publication of company data on environmental, social, and governance practices.

ESG rating — an independent assessment of a company’s ESG performance, used in investment decision-making.

ESG standard — a set of rules and norms governing the evaluation of ESG factors in company’s operations.

ESRS (European Sustainability Reporting Standards) — the EU sustainability reporting standards that specify CSRD requirements.

Governance — the core element of ESG that covers corporate transparency, ethics, and anti-corruption practices.

GRI (Global Reporting Initiative) — an international sustainability reporting standard widely adopted by companies worldwide.

Greenwashing — a practice in which companies claim to be environmentally or socially responsible without genuine action.

Micro, Small and Medium Enterprises (MSMEs) — a business sector for which specific ESG reporting tools have been developed.

MSP tools — simplified standards, platforms, and programs designed to help SMEs implement ESG reporting.

Non-financial reporting — company disclosures on non-financial aspects of operations, including environmental, social and governance issues.

Omnibus regulation — a general EU regulation that covers multiple areas, including ESG reporting.

Reporting standard — a set of requirements defining the structure and content of corporate ESG reports.

Responsible business — a business model that integrats social and environmental factors into company strategy.

SMEs (Small and Medium Enterprises) — enterprises classified by employee count and financial criteria, subject to adapted ESG requirements.

Sustainability — a concept of balanced economic, social, and environmental development that does not compromise the needs of future generations.

Sustainable finance — financial instruments and investments aimed at supporting ESG