When conducting a valuation analysis of a petrol station, it's not just about the litres; it's also about space economics, customer behaviour and brand strength.

Petrol stations have long since evolved beyond their traditional role of simply selling fuel for cars. Today, they are complex, integrated infrastructure units that include not only fuel dispensers, but also retail space, service areas, customer amenities and, sometimes, catering or car wash facilities. They are points of contact for drivers, elements of the logistics chain, and business platforms with diversified sources of income.

A modern petrol station is a commercially attractive asset, whether it operates as part of a retail chain or as an independent business unit with its own operating model. Given fierce competition, changing consumer behaviour, rising energy costs, and the growing importance of intangible assets, the valuation of petrol stations is of strategic importance. This is crucial for investors looking to acquire or develop a site, as well as for owners seeking to raise funds or exit the business.

Accurate valuation is also crucial for banking institutions, leasing companies, and franchisors that grant brand rights. This article discusses three basic, generally accepted approaches to determining the market value of a petrol station: the income approach, which focuses on future cash flows; the comparative approach, which is based on the analysis of market transactions; and the cost approach, which is based on replacement cost. Particular attention is paid to important aspects such as the valuation of additional commercial infrastructure elements (e.g. sales area, coffee shop, service station, electric charging stations), and the specifics of determining the value of facilities that are part of national or international petrol station chains.

All methodological approaches are adapted to Ukrainian realities and the regulatory environment. They are also aligned with the provisions of international valuation standards, particularly the International Valuation Standards (IVS) and the Royal Institution of Chartered Surveyors (RICS).

Valuing a petrol station is a complex, multi-level analytical task that requires a comprehensive approach and an in-depth understanding of the property's parameters and the full range of related business processes. Such factors as the facility's operating model, cost structure, fuel supply system and demand dynamics must be considered, as well as the legal and regulatory aspects of the petrol station's operation. This is particularly relevant during a period of structural changes in the fuel market, an unstable tax environment, and the growing importance of alternative energy sources. A professional valuation should consider the technical characteristics of the facility, such as the number of fuel dispensers, the size of the operator's room and its location, but also:

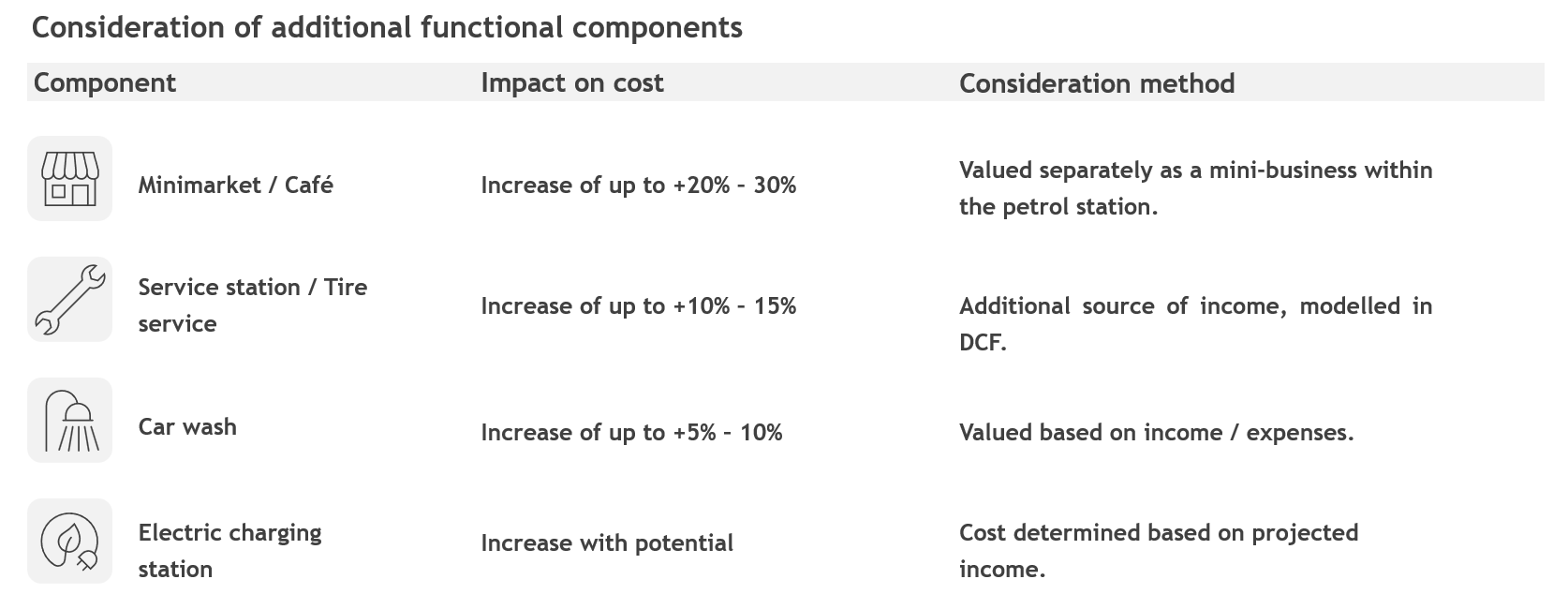

- the profitability of additional services, such as a mini-market, coffee shop, car wash, tyre fitting or service station

- the management structure, especially if the facility is part of a large network with centralised procurement, marketing, and service standards

- the market competitiveness, which is determined by traffic, service quality, customer loyalty and brand.

Using a combined approach that incorporates income, comparative and cost methods of valuation produces a balanced and reliable result. This approach improves the quality of the valuation and helps identify the key factors affecting the value of a particular asset, including intangible assets and future expectations. For investors, such a valuation provides the basis for informed investment decisions, including purchasing, restructuring or financing an asset. For owners, it provides an opportunity to justify the market or collateral value of an asset in negotiations with banks, partners or regulators. For the entire market, it represents a step towards greater transparency, professionalisation, and clear rules in a strategically important segment of the country's energy infrastructure.

The architecture and operation of petrol stations

In the modern sense, a petrol station is a commercial and service facility on the road network that combines trade and logistics with customer service.A petrol station is a specialised transport and commercial infrastructure facility whose main purpose is to provide motor vehicles with fuel and energy resources such as petrol, diesel, liquefied petroleum gas (LPG) and compressed natural gas (CNG) for internal combustion engines, as well as electricity for electric vehicles. In addition to selling fuel, many petrol stations also serve as service hubs, offering car washing, tyre fitting, vehicle maintenance and the sale of convenience goods, coffee and snacks.

Such facilities play an important role in the country's transport and logistics system. As well as serving as a refuelling point, they also provide drivers and passengers with a place to stop, rest and eat. Modern petrol stations are often seen as shopping and service complexes that combine real estate, commercial activities and services.

Petrol stations can operate as independent business units, owned by individuals or legal entities, or as part of a larger corporate structure, such as a regional or national network. In the former case, the facility operates under a well-known brand in compliance with corporate standards and is known as a franchise. In the latter case, it is a centralised element of its own network and is subject to a single management.

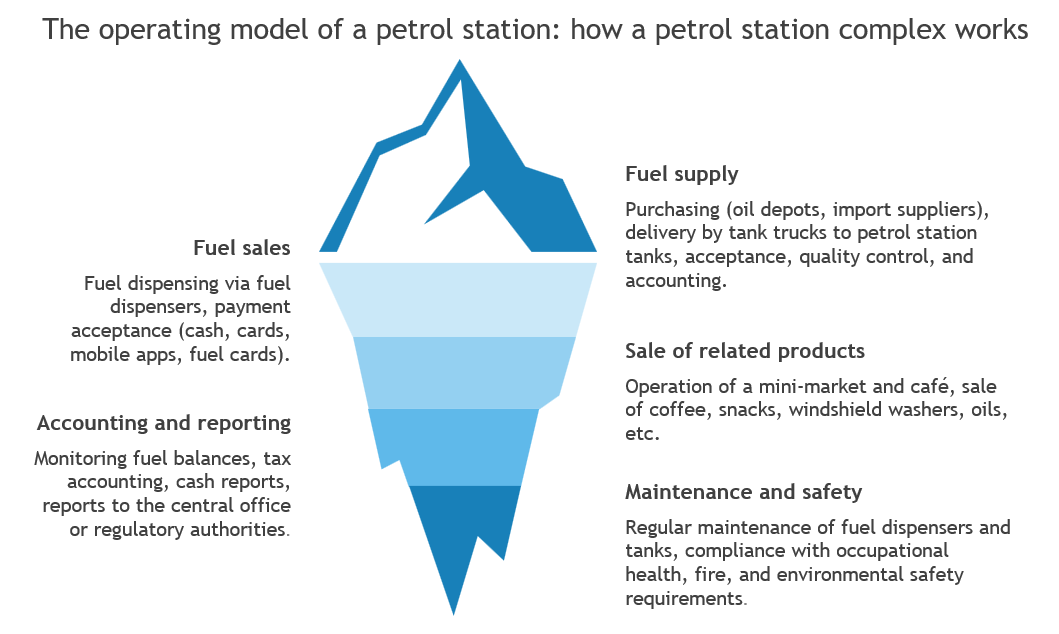

A modern petrol station operates according to a clearly structured model. This covers everything from fuel procurement to reporting and ensuring compliance with safety standards.

The five key stages of the operating model of a modern petrol station for its stable operation:

- Fuel supply: purchasing from tank farms or import suppliers, delivering fuel to the tanks by tanker truck, quality control and accounting.

- Fuel sales through fuel dispensers. Payments can be made in cash, by bank card, via mobile apps or with fuel cards. This is the main source of income for petrol stations.

- An important additional revenue stream is the sale of related products: many petrol stations have mini-markets or coffee zones selling coffee, snacks, oils and car care products. Such sales significantly increase the average spend and profitability.

- Accounting and reporting, which includes monitoring fuel balances, preparing tax and financial statements, and transmitting data to the central office or regulatory authorities.

- Maintenance and safety: regular maintenance of columns, tanks and ventilation systems, compliance with fire, environmental and occupational safety standards by personnel.

These stages form a single operating system that ensures efficient operations, high-quality service and compliance with market and legal requirements. The infographic below illustrates the logic behind these processes.

A multi-stream revenue model for petrol stations: from fuel sales to the provision of related services that generate sustainable profitability.

To increase profitability, mini-markets are developing by selling high-margin goods such as coffee, snacks, and car care products. These are often complemented by cafés or fast-food outlets, which increase revenue and improve the customer experience.Other sources of income include advertising, branding and fuel cards, which attract corporate clients and ensure stable sales volumes. Car washes, tyre fitting and technical services also help to increase the profitability of each visit. Electric charging stations are still in the early stages of development, but they have potential as part of urban infrastructure and transit hubs.

Taken together, these areas form a diversified financial model that reduces dependence on the volatile fuel market and ensures a sustainable income.

Algorithm for determining the cost

A reasonable valuation of a petrol station requires a combination of approaches that take into account its revenue structure, ownership type and legal restrictions.Valuing a petrol station is a complex process involving the analysis of real estate, infrastructure, business components and additional functional units.

According to international standards, a petrol station can be valued either as a separate property complex or as a functioning business.

To achieve the most accurate valuation, it is recommended that a combination of approaches is used, with mandatory adjustment for market realities.

The income approach provides a reasonable valuation of a petrol station by analysing cash flows and the profitability of its income sources.

Approach: the valuation is based on the property's ability to generate income in the future.

Features of the approach:

- It is important to model the profitability of each component of the petrol station separately

- There is difficulty in accessing reliable financial statements (especially for unaudited entities)

- The capitalisation rate takes into account the risk of the industry, region and competitive environment.

Application of the approach: this approach is most effective for operating petrol stations with a stable flow of customers and reliable financial statements.

The comparative approach is an effective method of valuing petrol stations, provided that a relevant transaction database is available and differences between comparison properties are correctly taken into account.

Approach: the value is determined by comparing it to similar properties that have been sold or are offered for sale.

Features of the approach:

- A deep local transaction base is required

- It is often difficult to obtain reliable information about transactions involving petrol stations (especially when the sale includes the business as well as the real estate)

- In developed jurisdictions (such as the USA and Germany), multipliers such as $/m², $/litre of fuel sold per year are used.

Application of the approach: effective for the valuation of individual properties in an active market.

The cost approach is appropriate for valuing newly created or non-operating petrol stations, where the physical structure rather than the asset's profitability plays a key role.

Approach: the cost is equal to the cost of creating a similar object, including depreciation.

Features of the approach:

- Does not take potential profitability into account

- Not suitable for valuing franchises or chains where brand value is a significant component

- It is used for new or inactive facilities, as well as for valuation for insurance purposes.

Additional services at a petrol station significantly increase its cost, so each component should be valuated separately as a source of profit.

Petrol stations that are part of large chains have brand value and a network effect. They are valued either as businesses with intangible assets (goodwill), or as part of a property portfolio (portfolio valuation).

Market trends

Ukraine's petrol station market is gradually recovering from the war-related turmoil, demonstrating adaptability and logistical flexibility, as well as a shift towards European fuel imports and related service development.

General overview

The Ukrainian petrol station market is a key element of the country's energy infrastructure. After the war-related shocks of 2022, the sector is expected to show a moderate recovery in 2024-2025. Despite these challenges, the industry has adapted thanks to flexible suppliers, a shift towards importing fuel from the EU and investments in logistics.

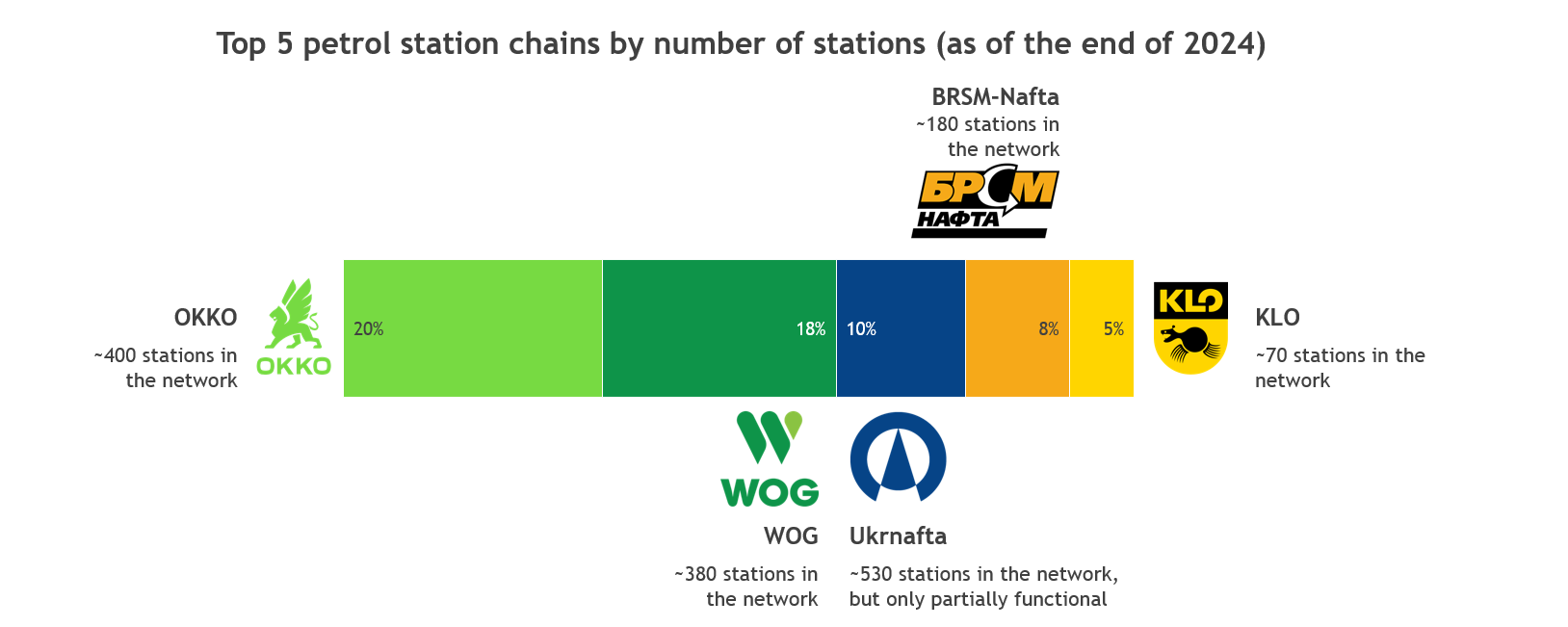

Number of operating petrol stations in Ukraine:

- Approximately 6,200 - 6,500 petrol stations

- Main concentration: western and central regions

- More than 30% of petrol stations are concentrated in the five largest networks.

The Ukrainian petrol station market has undergone significant transformation as a result of military operations, changes in logistics routes, and adaptation to new conditions.

Following the loss of the Kremenchuk refinery in 2022, the country shifted its fuel imports towards the western borders, particularly through Poland and Romania. This helped stabilise supplies and avoid a fuel shortage in 2023.

Main trends

- Reorientation of fuel imports:

• After the supply from Russia and Belarus stopped, the market shifted towards Poland, Lithuania and Romania (with sea deliveries via the ports of Reni, Izmail and Constanța)

• Diesel and petrol are mainly supplied by tanker trucks, affecting logistics costs.

- Growing interest in electric charging infrastructure:

• The number of electric charging stations doubled between 2020 and 2024

• Petrol station networks are integrating charging hubs in large cities and on transit routes.

- Transformation of petrol stations into multifunctional hubs:

• The role of additional services is growing, offering cafés, shops, car washes and post offices

• The share of revenue from related services reaches 20 - 30% for market leaders.

Influencing factors and challenges

- Military operations: restrictions on operations in the eastern and southern regions.

- Oil price fluctuations: dependence on global markets.

- Government regulation: licensing and fuel quality control.

- Logistical problems: queues at the border and a lack of tankers.

Forecast for 2025-2026

- Stabilisation of fuel prices if macroeconomic stability is maintained.

- Further reduction of the grey market through digitalisation of controls.

- Growing demand for charging stations and integration of energy services.

- Consolidation: large players will continue to buy up smaller networks.

OKKO and WOG will continue to dominate the petrol station market, accounting for more than a third of fuel sales in Ukraine and setting the standards for quality and service.

The Ukrainian market for charging stations has doubled over the past five years, confirming the steady growth in demand for electric vehicles and the transformation of the country's energy infrastructure.

- The electric mobility market in Ukraine has grown steadily over the past five years. Since 2020, the number of charging stations has almost doubled, indicating that the market is actively adapting to the global decarbonisation trend in transport.

- The largest increase was observed in 2023, when the number of EVSE (electric vehicle supply equipment) exceeded 4,700 units. Growth continued in 2024, albeit at a slower pace, with the market reaching around 5,000 stations.

- The development of charging infrastructure is accompanied by the integration of charging points into petrol station networks, shopping mall car parks, and locations near office centres and residential complexes. This creates new opportunities for transforming the transport system and increasing energy independence.

In summary, the Ukrainian petrol station market is demonstrating resilience and moderate growth as it adapts to new challenges and introduces innovations. Provided that the overall macroeconomic balance in the country is maintained, fuel prices are expected to remain stable in 2025-2026. Digitalisation of control will reduce the grey market. Demand for charging stations and energy services will grow, and large networks will continue to absorb smaller ones, thereby strengthening their position.

BDO in Ukraine regularly conducts detailed market research to help businesses respond quickly to changes, identify new opportunities, and plan their development effectively. We also provide valuation of business and financial modelling services, including the valuation of petrol stations. If you would like more information, please contact us — we will be happy to answer your questions.

*This publication contains general information and does not constitute professional advice or service. You should consult a qualified professional advisor before making any decision or taking any action that may affect your finances or business. Please contact BDO in Ukraine for further advice and support.