Amid wartime conditions and global pressures, Ukraine stands out for its resilience and continuous investor-friendly environment.

The team of BDO in Ukraine regularly receives inquiries from individuals, companies and international clients about the business registration process in Ukraine. After all, our country remains open to entrepreneurial initiatives. Many investors and entrepreneurs are investing in Ukraine, considering it a promising market for development. Given the relevance of the topic, we have prepared a brief but practical overview of the main steps to consider when starting a business.

Steps to start a business in Ukraine during martial law

The basic procedure for starting a business remains simple (and some steps have been simplified under martial law):1. Choose a legal form. The first step is to determine the legal structure. The most common options:

- Sole Proprietorship (FOP) — suitable for small businesses with a simple accounting and low tax burden

- Limited Liability Company (LLC) — a versatile structure for most SMEs, combining flexible management with limited liability for the founders

- Joint-Stock Company (JSC) — an optimal choice for large-scale businesses focused on attracting investors

- Representative Office — allows you to operate in the Ukrainian market without establishing a separate legal entity.

Each form has its own registration and reporting requirements.

2. Choose a name for your company

The name should be unique, comply with the requirements of Ukrainian law and not duplicate existing names. It is recommended to check it through the Unified State Register of Legal Entities to avoid legal conflicts.

3. Register your company

To register a company, you should submit to the state registrar the constituent documents, information about the founders and, necessarily, the ultimate beneficial owners (UBOs). Ukrainian law requires transparency of the ownership structure, especially due to the sanctions policy. Most steps in the registration process can be handled online through government services, and the overall procedure has been simplified under martial law.

4. Open a bank account

A corporate account is opened in a Ukrainian bank in compliance with the standard verification procedure, which includes verification of the UBOs data. Due to currency restrictions, it is advisable to open accounts in both hryvnia and foreign currency.

5. Obtain licences and permits

You should check whether your business activity falls under regulated sectors (e.g. finance, healthcare, education, energy). In such cases, additional licensing is required. During the wartime, the government has temporarily simplified certain requirements and limited inspections to ease the launch of new businesses.

6. Hire employees

After registering a company, you can move on to building your team. Several formats of employment are available: classic employment contracts, civil law contracts for freelancers or project-based contractors, and gig contracts — particularly for Diia.City residents. When hiring foreigners, a work permit is usually required unless the individual holds permanent residence or is employed by a representative office. Under martial law, the government has significantly accelerated the permit issuance process and simplified bureaucratic procedures.

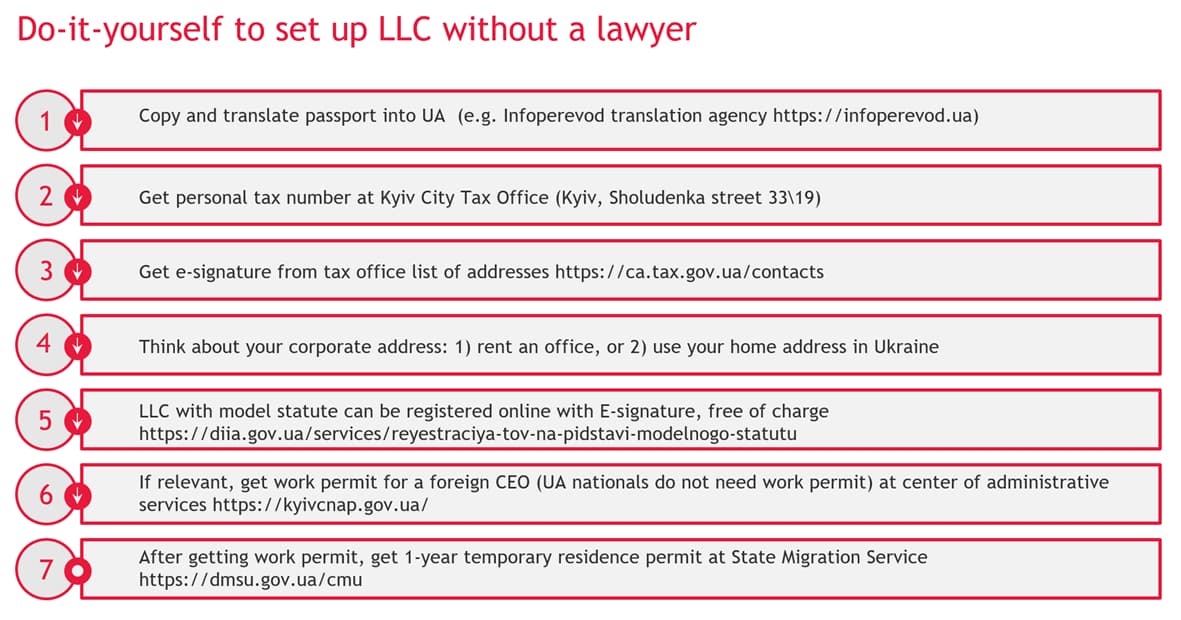

Setting yourself a company

Establishing a Limited Liability Company (LLC) in Ukraine can also be an affordable process without the involvement of a lawyer, if you follow a clear sequence of actions. Below is a step-by-step guide that covers the key stages: from drafting documents to registering the company and obtaining the necessary permits. This algorithm allows you to independently organise the legal registration of your business in compliance with the requirements of the current legislation of Ukraine.

Checklist to DIY business setup without a lawyer:

1. Copy and translate your passport into Ukrainian, for example, at a translation agency2. Get personal tax number at Kyiv City Tax Office (33/19 Sholudenko St., Kyiv)

3. Get e-signature from tax office list of addresses.

4. Think about your corporate address:

a. Rent an office

b. Or use your home address in Ukraine

6. If relevant, get work permit for a foreign CEO (Ukrainian citizens do not need work permit) at centre of administrative services -> available at the link

7. After getting work permit, get 1-year temporary residence permit at State Migration Service - > available at the link

For step-by-step instructions on how to register a business in Ukraine, including legal forms, current requirements and peculiarities of doing business during martial law, download our brochure — a handy and practical guide for foreign entrepreneurs and investors.

The business environment has undergone significant transformations in recent years: company registration procedures have been simplified, electronic services have been introduced, and tax regimes have been simplified. This creates an attractive business environment — even for those who have no experience in the Ukrainian legal system.

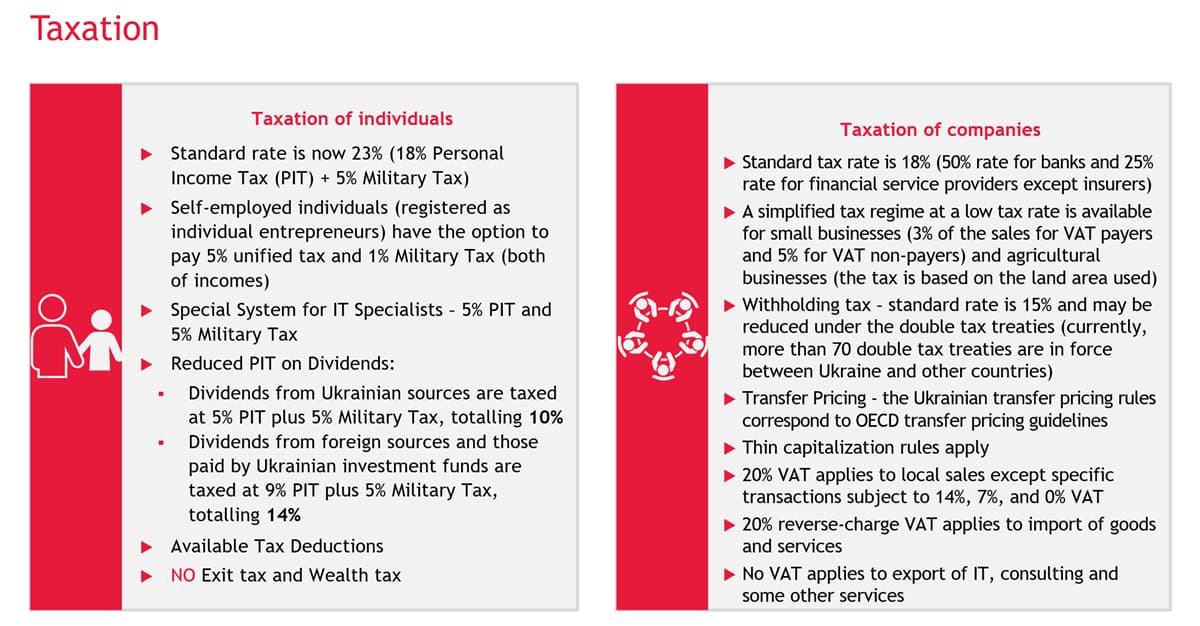

Ukraine’s tax environment

In 2025, Ukraine’s tax system demonstrates both stability and adaptability to the conditions of martial law. Individuals are subject to both a general taxation regime (23% in total) and tax incentives for entrepreneurs and IT professionals. In the area of corporate taxation, the basic corporate tax rate remains at 18%, with higher rates applied for banks and certain financial institutions, as well as simplified taxation for small businesses. Special attention is paid to international norms: more than 70 double taxation treaties, transfer pricing rules in line with OECD standards, and differentiated VAT rates with zero taxation for IT and export services. This structure allows for transparency, business support and adaptation to global financial reporting requirements.

Key takeaways

Despite restrictions on currency transactions, labour and logistics, the government is taking a proactive approach by introducing tax benefits, simplified procedures and employee booking mechanisms for critical infrastructure companies. The business community also demonstrates flexibility and the ability to adapt quickly, maintaining economic activity and supporting the country’s resilience in the face of the emergency legal regime.Ukraine provides conditions for maintaining a favourable investment climate and supports business activity even under martial law. For foreign companies planning to enter the Ukrainian market or expand their existing business, it is important to consider the updated legal framework, currency regulation and labour requirements. With proper planning, regulatory compliance, and the involvement of local experts, such as the team of BDO in Ukraine, international investors can successfully implement projects, supporting the country’s economy while ensuring the sustainable development of their own business.

If you are planning to start or develop a business in Ukraine and are looking for expert support, the team of BDO in Ukraine is here to support you with expert guidance tax, legal, audit, consulting and more. Get in touch using our online form and we will support you in confidently exploring business opportunities in Ukraine.