Prepared by the experts of BDO in Ukraine, this analysis is intended for companies striving to drive effectively the recovery projects, access global funding, and navigate strategic choices in today’s complex landscape.

As of September 2025, Ukraine remains engaged in a full-scale war following russia’s invasion in 2022. Despite ongoing hostilities, the country continues to pursue recovery and reform across critical sectors. This overview is structured around four principal dimensions presented by BDO Ukraine: the frontline, infrastructure, economy, and international assistance.

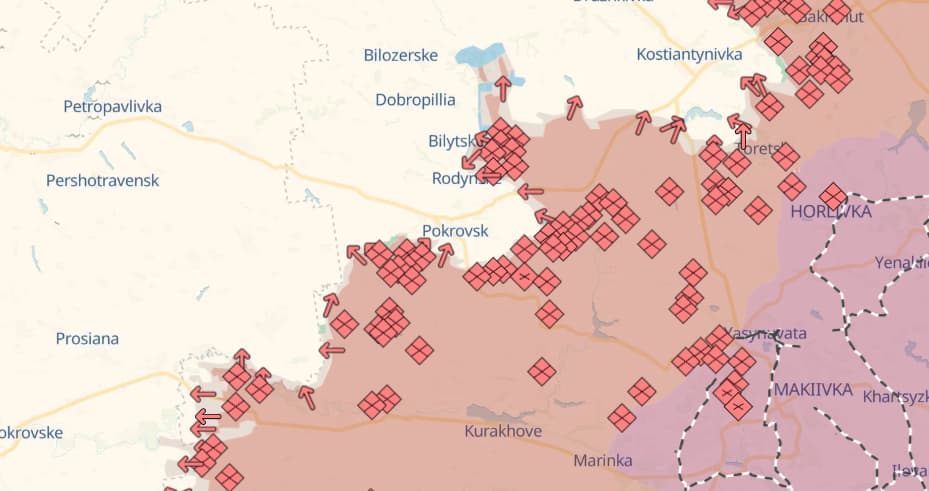

1. Frontline Situation and Strategic Outlook

Military operations persist across several regions, with intensified activity near the Dnipro and Sumy oblasts. Despite the scale of the russian offensive, its operational results remain negligible. After the initial land grab at the start of the invasion, further territorial gains have amounted to only a few percent—achieved at the cost of staggering losses. Crucially, russian forces have not advanced a single metre beyond the administrative borders of Dnipropetrovsk oblast. (1)

Ukrainian defence remains effective, supported by tactical manoeuvres, fortified positions, and the widespread deployment of FPV drones. Notably, in June 2025 Ukraine’s Security Service executed Operation Spider’s Web, a landmark asymmetric strike using truck-launched FPV drones deep inside russian territory. Over 117 drones, covertly smuggled and launched from disguised cargo vehicles, targeted four strategic airbases, destroying or damaging more than 40 high-value aircraft. (2)

Although discussions regarding a potential ceasefire have emerged, the prerequisites for a sustainable truce — mutual exhaustion and a stabilised front—have not yet materialised. russia shows no willingness to halt hostilities, and meaningful negotiations appear possible only under the pressure of severe economic consequences.

As the United States seeks to end the war in Ukraine, its approach has heightened tensions with Kyiv and strained NATO relations. Despite strong rhetoric from White House and formal dissatisfaction of russian actions (including massive strikes over civil infrastructure and buildings), during 2025 no new sanctions over russina from the United States were implemented as well as no new aid packages to Ukraine were introduced while the biggest change was the new mechanism of purchasing American weapon for EU money. On 15 August, President Trump met with the russian leader in Anchorage, Alaska, aiming for a ceasefire. However, the talks produced no results whatsoever — no agreement, no roadmap, and no sign of progress. (3) Nevertheless, signs of economic strain in Russia and Ukraine’s increasing capacity for strategic strikes (including massive drones’ production and introduction of new large cruise missile Flamingo) may influence the trajectory of the war by the end of the year.

2. Infrastructure Damage and Recovery Efforts

The war has inflicted extensive damage on Ukraine’s infrastructure. As of early 2025:

- Over 247,000 residential buildings have been damaged or destroyed; approximately 30% have been restored.

- In education, more than 4,000 institutions were affected, with 1,186 fully restored.

- In healthcare, 2,285 facilities were damaged, of which 964 have been rebuilt. (4)

Ukraine’s reconstruction over the next decade will require US$524 billion across both public and private sectors, reflecting the immense scale of damage. Public sector priorities include restoring essential infrastructure—energy, transport, and municipal services—while ensuring modern standards for resilience and safety. At the same time, private sector recovery is critical for economic revival, with productive sectors such as agriculture, commerce, and industry needing over US$132 billion to restart operations and attract investment. (5)

Ukraine’s recovery needs for 2025 alone are estimated at $17.3 billion, with only $7.4 billion currently funded. The largest shortfalls are observed in:

- Energy: $3.5 billion

- Housing: $3.4 billion

- Transport: $730 million

To enhance transparency and efficiency, Ukraine has implemented the DREAM platform for public investment management.

In 2024:

- 1,800 tenders were issued, totalling ₴16.9 billion.

- However, 79% of these tenders were non-competitive.

- Only 70–78% of planned funds were actually disbursed.

The Single Project Pipeline currently includes 787 projects, spanning both capital and operational expenditures, with a total estimated value of $61.67 billion.

For 2025:

- 304 projects have been identified as priority needs, requiring $11.88 billion.

- 92 projects have secured financing totalling $5.25 billion.

- An additional 10 projects outside the capital budget have received $0.21 billion.

- In total, 348 priority projects for 2025 require $17.32 billion.

- 44 programmes have been identified as priority needs, requiring $4.44 billion, of which 18 programmes have received $1.9 billion in allocated funding.

The DREAM system represents a significant institutional reform aimed at improving the efficiency of public investment, but its success will depend on continued international support and domestic implementation capacity. (6)

3. Macroeconomic Conditions and Fiscal Policy

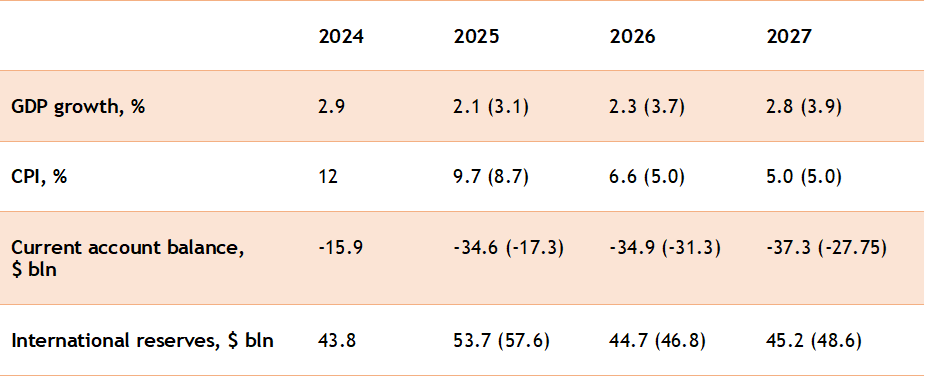

The National Bank of Ukraine (NBU) has published its revised macroeconomic forecast for 2025–2027, reflecting the ongoing impact of the full-scale war, infrastructure damage, labour shortages, and external trade disruptions. The updated projections show a more cautious outlook compared to earlier estimates, with adjustments across key indicators. (7)Updated Forecast Summary (July 2025) (8)

Despite positive growth rates, the size of GDP in 2024 remains approximately 92% of the pre-war level (2021). The medium-term outlook anticipates gradual recovery, contingent on security improvements and sustained external financing.

Inflation and Monetary Policy

- CPI Dynamics: Inflation is projected to decline from 12% in 2024 to 8.7% in 2025, approaching the NBU’s target of 5% by 2026–2027.

- Foreign Reserves: International reserves reached an all-time high of $43.8 billion in 2024, with projections of $57.6 billion in 2025.This record level is largely attributed to sustained international financial support, which has played a critical role in ensuring exchange rate stability and enhancing policy flexibility.

Banking Sector and Fiscal Position

- The banking system remains profitable; however, corporate lending is limited. A 50% windfall tax on bank profits has been in effect since 2023.

- Ukraine operates a “war budget”, with approximately 50% of state expenditure allocated to defence. Defence spending is expected to exceed 30% of GDP by 2027, compared to NATO’s 2–5% benchmark.

External Sector

- Current Account: The deficit is projected to widen from $15.9 billion in 2024 to $34.6 billion in 2025 (baseline scenario).

- Trade and production: Ukraine’s trade deficit is widening as exports in July 2025 rose by just 9.2% year-on-year, while total exports for January–July remain 1.5% below 2024 levels. Imports, driven by wartime needs such as machinery, transport, and weaponry, surged by 18.7%, returning to pre-invasion volumes. Export losses —especially in extractive industries — are largely irreversible due to occupation and destruction of infrastructure. In the agricultural sector, despite reduced yields in early grain and oilseed crops with winter cereals down 10 percent and rapeseed down 9 percent, Ukraine expects a strong overall harvest in 2025 supported by late-season crops. According to USDA projections, wheat output will reach 22 million tonnes and corn 32 million tonnes with expected exports of 15.5 and 22.5 million tonnes respectively. (9)

Reasons for Forecast Revision

The National Bank of Ukraine revised its macroeconomic forecast due to several compounding factors: lower agricultural output caused by weaker harvests and war-related damage, deteriorating security conditions with intensified shelling, rising inflation driven by increased costs and currency depreciation, and slower real GDP growth accompanied by a higher deflator. Additionally, fiscal pressures have grown due to expanded defence and stimulus needs, while trade imbalances have deepened as exports decline and imports rise.According to the July 2025 macroeconomic forecast compiled by the Centre for Economic Strategy, Ukraine’s nominal GDP is expected to reach 210 billion US dollars by the end of the year, surpassing the pre-war record set in 2021. Real GDP growth is projected to slow to a median of 2.25 percent, reflecting the ongoing impact of the war. Inflation is forecast to ease to 9.35 percent by year-end, while the hryvnia is expected to depreciate moderately, averaging 42.1 UAH/USD. The National Bank of Ukraine is projected to increase its international reserves to 52 billion US dollars. However, the budget deficit remains substantial at 21 percent of GDP, with financing needs estimated at 57 billion US dollars—largely covered by international assistance. The current account deficit is also expected to deepen, driven by high import demand and constrained export recovery. All forecasts assume the war will continue throughout 2025, with limited expectations for renewed US military aid. (10)

International Assistance to Ukraine

Ukraine received substantial international support totalling $41.6 billion in 2024, including $29 billion in concessional loans and $12.6 billion in grants. The European Union was the largest lender, while the United States led in grant contributions. Other key donors included Japan, Canada, the United Kingdom, Norway, and South Korea.This assistance has been critical in covering Ukraine’s budget deficit of 17.6% of GDP, stabilising the economy, and supporting defence and recovery efforts. Without it, the fiscal gap would have reached 32.5% of GDP. Cumulatively, aid from 2022 to 2024 has included military, humanitarian, and financial support, with ongoing discussions about the use of frozen Russian assets and future funding structures. (11)

International assistance continues to play a crucial role in supporting Ukraine’s financial stability. Key contributors include Germany, which provided 1.6 billion euros in direct budget assistance, primarily in grants, and the European Union, which allocated 22.6 billion euros through the Ukraine Facility and an additional 9 billion euros via the ERA mechanism funded by frozen Russian assets. In 2025, more than 28 billion US dollars in external financing has already been mobilised, against the annual requirement of 39.3 billion US dollars. (12)

Ukraine, for its part, is actively implementing reforms to meet its commitments under international cooperation agreements. The Government recently completed the eighth review of the IMF’s Extended Fund Facility programme, marking a significant milestone. Progress has also been made in fulfilling the conditions for accessing funding under the EU’s Ukraine Facility. A key achievement is the introduction of the Public Investment Management (PIM) reform, designed to improve the efficiency and transparency of public spending on recovery.

Additionally, in 2024, over 75 percent of the planned actions under the National Revenue Strategy were completed, including the adoption of two key tax bills to harmonise national legislation with EU standards. These included the gradual increase of excise duties on tobacco and fuel, aimed at aligning rates with EU minimum levels. Additionally, the Ministry of Finance approved a methodology for evaluating tax benefits, allowing the identification and replacement of outdated or inefficient incentives. These steps have already contributed to strengthening fiscal sustainability and enhancing the efficiency of the tax system. (13)

Key Takeaways

Ukraine’s security posture remains firm, but the outlook requires sustained vigilance. Operational resilience should be leveraged to strengthen layered air defence, counter‑drone systems, and fortifications, while lessons from recent asymmetric strikes highlight the value of mobility and deception in degrading high‑value targets. Negotiations remain unlikely without significant external pressure, so planning must assume a protracted phase while keeping conditional dialogue frameworks ready.Reconstruction and investment remain one of the key priorities. Despite the introduction of governance tools such as DREAM and PIM, progress is constrained by a significant shortfall in funding. To accelerate recovery, Ukraine needs not only transparent processes but also a stronger flow of capital. This requires prioritising projects that deliver both essential services and long‑term resilience — such as reinforced energy infrastructure and secure municipal facilities — while ensuring competitive procurement, strict milestone control, and technical support for local authorities to improve implementation capacity.

Ukraine continues to demonstrate resilience in the face of full-scale war, but the macroeconomic situation remains challenging. Inflation is gradually declining, yet it remains above the NBU’s target and higher than early-year expectations, mainly due to war-related losses, higher business costs, and weaker harvests. Economic growth persists, but at a slower pace than previously forecast, reflecting systemic constraints such as labour shortages, damaged infrastructure, and high defence spending.

Over three years after the full-scale invasion of Ukraine, around 25% of Ukrainians remain displaced: 3.8 million internally and 5.6 million abroad (including 5.1 million in Europe). At the same time, 4.1 million people have returned to their places of origin, including 1.1 million from abroad. (14) The recovery is further limited by subdued consumer demand and negative migration trends, with a significant portion of the workforce remaining abroad. Fiscal deficits remain high, driven by increased defence and social spending, and the economy’s reliance on substantial international financial assistance continues. While monetary policy has helped stabilise inflation expectations and the currency market, the outlook for sustainable growth and reconstruction depends on improving the security environment, restoring productive capacity, and maintaining external support. Addressing structural challenges — particularly in the labour market, energy sector, and agricultural production — will be essential for Ukraine’s long-term recovery and macroeconomic stability. (15)

There is an alternative scenario, that is built on the assumption that a stable ceasefire or peace agreement will be achieved throughout 2026. (16) Scenario assumes faster security improvements, lower fiscal deficit, and reduced labour market pressures. Under these conditions, GDP growth could exceed 3% in 2026–2027, inflation would stay close to baseline, the budget deficit would decline to 12.6% in 2026 and 6.8% in 2027, and the debt-to-GDP ratio would fall to about 90% by the end of the forecast horizon.

BDO in Ukraine — your trusted partner in recovery and development

In the face of the major challenges Ukraine is currently experiencing, effective planning, access to financing, and analytical support are critically important for ensuring sustainable economic growth and the successful implementation of strategic initiatives.BDO in Ukraine provides professional support to organisations that are planning to implement recovery projects, attract funding, or require in-depth analytical assistance. We offer:

- Analytical research — including market reviews, competitive analysis, and forecasts that serve as a foundation for well-informed management decisions.

- Support in attracting financing — assisting in obtaining grants and loans from international donors, including preparation of applications, financial models, and negotiation support.

Our team will structure your initiatives in accordance with international partner requirements, ensure transparency throughout the process, and support the successful implementation of your projects.

Please fill out the form, and we will contact you to discuss possible areas of cooperation.