Webinar Takeaways on Non-Financial Reporting: Deadline Extension Does Not Remove Obligations

Webinar Takeaways on Non-Financial Reporting: Deadline Extension Does Not Remove Obligations

Experts of BDO in Ukraine held a practical webinar dedicated to current changes in non-financial reporting and the impact of European directives on Ukrainian companies.

The event brought together experts, business representatives and consultants who discussed key innovations, challenges and practical recommendations for preparing for the new requirements.It was noted by webinar participants that there has been a significant increase in interest in non-financial reporting in recent years. This has been driven by European integration processes and increased requirements from international partners. In accordance with the new EU directives, particularly the Omnibus package, the deadlines for mandatory reporting for many companies have been postponed, providing additional time for the high-quality preparation and implementation of the necessary changes in internal processes.

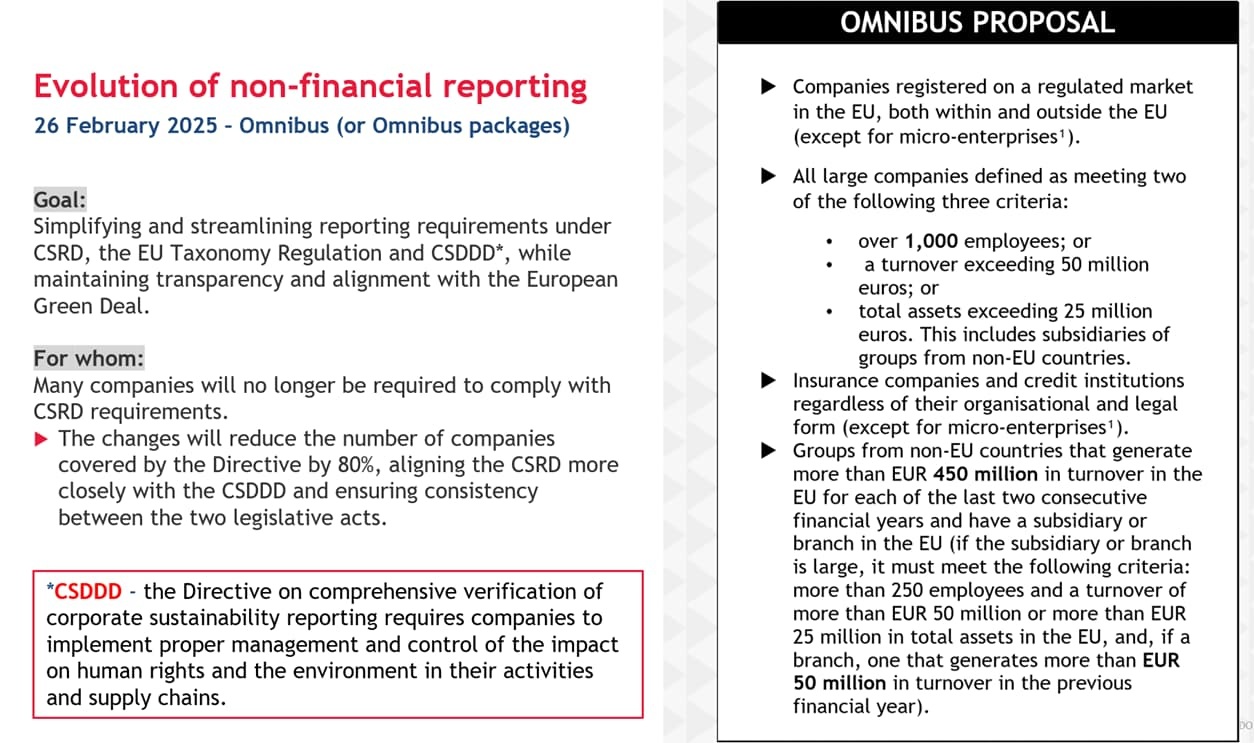

Omnibus Package and CSRD Timeline

In her speech, Olexandra Ryabtseva, specialist in the ESG department, said that the Omnibus package of changes aims to simplify and streamline reporting requirements, as well as maintain transparency and compliance with the European green course. She explained that the changes will reduce the number of companies covered by the directive and postpone the reporting deadlines for some stages by two years. Olexandra emphasised the importance of introducing non-financial reporting:

“Even if your company is not currently subject to reporting requirements under the directives, or your reporting stage has been postponed, this does not mean that financial reporting should be neglected since financial reporting is an important element of business competitiveness and fundraising.”

“Double materiality” — a key principle of reporting under ESRS standards

Anastasiia Skok, head of ESG department at BDO in Ukraine emphasised the importance of double materiality, which links two impacts: on the surrounding world and on financial stability.

Impact Materiality evaluates a company’s environmental and social impact, considering factors such as resource consumption, emissions, human rights compliance, and working conditions. This is the so-called ‘external view’, which considers the company’s impact on the surrounding world.

Conversely, Financial Materiality assesses how environmental, social and governance factors influence business’s financial health, profitability and risk profile. This is an ‘internal view’ — the impact of the world on the company.

It is at the intersection of these two dimensions that a holistic understanding of ESG risks and opportunities is formed, enabling strategic decisions to be made rather than simply complying with reporting requirements. This approach transforms reporting from a mere formality to an integral part of the management culture, paving the way for sustainable business development.

Ukrainian context

Ukraine has not yet established a separate regulator responsible for non-financial reporting, but a strategy for implementing ESRS standards has already been approved. According to this strategy, mandatory non-financial reporting for large companies is expected to begin in 2028, and the requirement will subsequently be extended to medium and small businesses. However, Ukrainian companies that cooperate with EU partners or participate in international tenders already must prepare such reports today, as any delay could lead to the loss of contracts and partnerships, as noted by Anastasiia Skok. The expert also provided practical advice on preparing for reporting:

“The best approach is not to overload all departments once a year. Instead, it would be more effective to collect all the information in one place throughout the year. This approach ensures that the reporting process becomes an integral part of the business system, rather than a standalone initiative with a defined deadline.

First steps for implementing non-financial reporting:

- Assess readiness and strategy — audit existing sustainability programmes and compare them with the requirements of the directive and standards.

- Develop or update internal policies (environmental management, codes of ethics, risk management policy).

- Implement a data collection system — automate processes to avoid manual work.

Train staff — especially the finance department, which is often responsible for preparing non-financial reporting. - Integrate non-financial reporting with financial processes.

- Continuously monitor updates to standards and regulations..

Victoriia Sukhanenko, head of Health and Safety Consulting department, presented the classic international standard for non-financial reporting, GRI (GRI Standards), its principles and benefits for Ukrainian companies.

She emphasised that GRI is a voluntary standard that enables companies to gradually develop their reporting without unnecessary complexity. It is one of the world’s best-known non-financial reporting standards, based on the principles of transparency, completeness, clarity and consistency:

“GRI is not a mandatory standard; it is a voluntary initiative that requires significant resources to adapt, especially for small and medium-sized businesses. This standard enables a phased implementation of the reporting process.”

The role of reporting in attracting foreign investment

Non-financial reporting is no longer a passing fad; it has become a key indicator of trustworthiness for investors. Transparency in matters of environmental impact, social sphere and corporate governance is key to enabling companies to be understood and predictable by international partners. This is a key factor in decisions regarding the attraction of foreign investment.

- Non-financial reporting is an indicator of business transparency and accountability, allowing foreign investors to better assess the risks and long-term potential of a company.

- Openness in matters of environmental, social and corporate governance is essential for building trust, without which foreign capital will not enter the country, especially in conditions of uncertainty.

- Implementing reporting standards such as ESRS or GRI enhances a company’s reputation and facilitates the attraction of international partners and investments.

In this context, BDO in Ukraine also sets the pattern — the company recently published its ESG report for 2024, which presents practical steps for integrating sustainability principles into corporate strategy and operational activities.

The webinar was moderated by Andrii Borenkov, head of Advisory, who ensured that the discussion ran smoothly and that the time limits were observed. In his comments, he also emphasised the importance of business process automation as a necessary condition for preparing for the implementation of CSRD requirements and improving the effectiveness of management decisions.

The webinar recording can be viewed through this link.

Key takeaways from the webinar:

1. Postponing deadlines does not imply the cancellation of requirements.

Postponing reporting deadlines merely provides companies with extra time to adapt their processes, but the reporting obligation remains. Today, businesses should initiate the development of systems for the collection of non-financial data, the identification of relevant sustainability indicators and the conducting of internal impact assessments.

2. ESRS as the basis for future reporting.

ESRS standards establish a clear framework for reporting on sustainable development. Ukrainian companies working with EU partners are already required to comply with these standards, even though the relevant legislative requirements are still in the process of harmonisation.

3. Transparency is key to investor confidence.

The webinar emphasised that non-financial reporting is not just a formal requirement, but a tool for increasing companies’ competitiveness. Demonstrating openness on environmental, social and governance issues contributes to fostering trust among partners, donors and consumers.

Non-financial reporting is not only a new legal requirement; it is also a tool for building trust and increasing business competitiveness. It facilitates the establishment of international partnerships, financing and investment opportunities, as it demonstrates a systematic approach to sustainable development. If you are still unsure which reporting standard — ESRS or GRI — is best for your company, we recommend reading the analytical article Which to use in Ukraine: ESRS or GRI?.

The team of BDO in Ukraine is prepared to assist you in selecting the most suitable approach, evaluating your company’s preparedness for reporting, and implementing practical solutions for sustainable business development. Should you require any further information, please do not hesitate to contact our experts.