Implementing International Financial Reporting Standards (IFRS) affords new possibilities for an entity. The activity of such an organization becomes more transparent that results in growing confidence of new partners and customers.

Since 2020, Ukrainian legislation allows (and obliges some entities) to keep accounting under IFRS. Many companies solve this problem by transforming their financial statements in accordance with IFRS. But the transformation process is quite time-consuming and, as a rule, is performed manually.

To automate accounting under IFRS, BDO has developed a number of specialized modules for the most common accounting programs in Ukraine. The developed modules include:

- Inventory markdown reserve

- Discounting of financial loans

- Provision for accounts receivable

- Leases

- Provision for vacation

- Financial instruments

- Biological assets of crop production

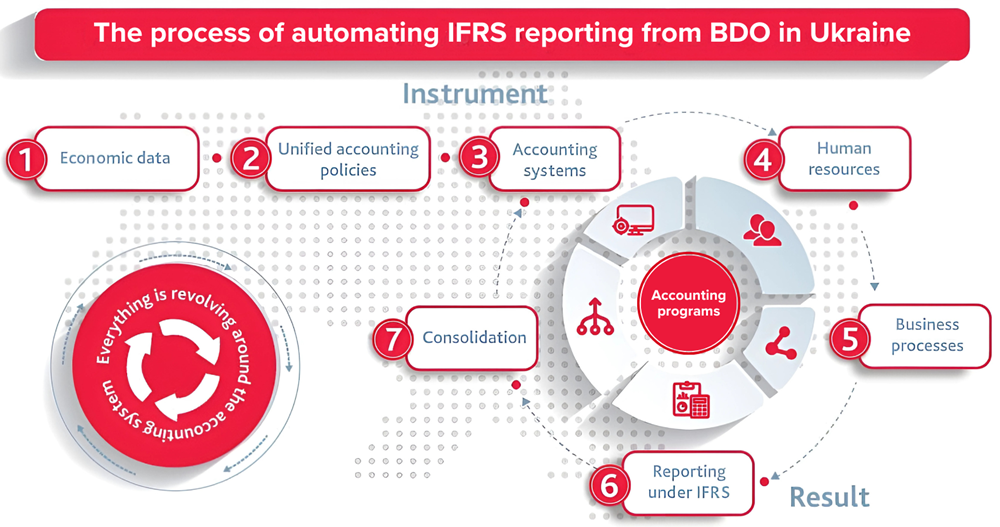

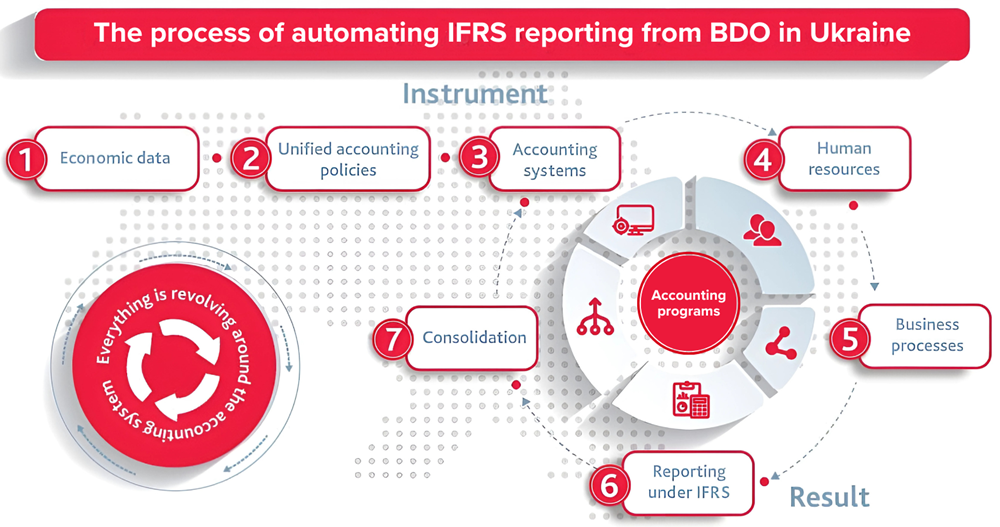

BDO in Ukraine is ready to perform a complex of works on automation of IFRS accounting "on a turn-key basis" (see the Work Plan below), and to provide only services necessary to the customer.

The Work Plan on automation of accounting according to IFRS

- Analysis of the Company's business for the purposes of determining the structure of the Accounting Policy Statement: main sources of income, main areas of expenditure, analysis of existing items of assets and liabilities

- Study of the existing accounting policy of the customer (approaches used to account for assets, liabilities, income, expenses, equity)

- Development of a draft accounting policy under IFRS for accounting and preparation of separate financial statements

- Development of a draft accounting policy in accordance with IFRS regarding the preparation of consolidated financial statements of the group of companies

- Analysis of tax effects of the difference between current reporting practices and IFRS policies

- Development of a plan for the transition from accounting according to NAS to accounting according to IFRS

- Development of the BDO modules for setting up management accounting according to IFRS (as appropriate, if the configuration of the customer's has significant differences from the standard one)

- Integration of the BDO modules into the customer's accounting system

- Training of personnel to work with the established BDO modules for IFRS

- Assistance in filling out reference information and launching the BDO modules for IFRS

- Support for the submission of the first financial statements (quarterly or annual)

For more details about BDO's IFRS services in Ukraine read here.

Advantages of implementing automation of accounting in accordance with IFRS

- Considerable acceleration of the work of the customer's accounting staff

- Reducing the number of errors (which can occur even in calculations made manually and afterwards mechanically entered into the program)

- Reducing the time and audit cost

- Reducing the risk of fines from the SFS

- Enhancing the chances of obtaining a loan from foreign banks or investors

- Increasing the objective value of business.

Why do you need automation of accounting according to IFRS from BDO in Ukraine?

- Optimal price/quality ratio

- Comprehensive turnkey service (methodology + IT)

- Ready-for-service IFRS modules that BDO in Ukraine demonstrates to the customer on a demo basis

- A quick result of automation of accounting under IFRS if the customer has a ready-made accounting policy (or parts thereof, in accordance with the selected IFRS modules)

- The ability to adapt the IFRS modules to the customer's requirements

- Positive experience in implementing accounting automation under IFRS in various industries (Agribusiness, Retail chains, Industry, IT)

To learn more about the automation of accounting under IFRS from BDO in Ukraine, contact our specialists.

/%D0%90%D0%B2%D1%82%D0%BE%D0%BC%D0%B0%D1%82%D0%B8%D0%B7%D0%B0%D1%86%D1%96%D1%8F-%D0%B7%D0%B0-%D0%9C%D0%A1%D0%A4%D0%97/Write-to-us-eng.png.aspx?lang=en-GB)