Roman Gruba

The introduction of mandatory reporting in accordance with IFRS in Ukraine began with amending the Law of Ukraine dated 16 July 1999 No. 996-XIV "On Accounting and Financial Reporting in Ukraine".

International Financial Reporting Standards or IFRS — a set of standards and interpretations that govern the rules for preparing financial statements. They are developed by the International Accounting Standards Board (IASB) and define the reporting rules for entities. Currently, IFRSs are used as the basis for preparation of financial statements by entities in more than 120 countries of the world.

The objective of IFRS is to unify financial statements regardless of the geolocation of the business. The goal is to make the work of entities transparent in order to ensure the stability of financial markets and the development of the world economy. Financial statements prepared in accordance with the requirements of IFRS are a sort of “quality mark” and confirmation that the information provided is reliable.

The Verkhovna Rada of Ukraine amended the law "On Accounting and Financial Reporting in Ukraine" dated 5 October 2017, No. 2164-VIII, whereby Ukrainian entities are obliged to prepare IFRS financial statements that meet the following criteria:

Public interest entities

Large enterprises are enterprises that do not meet the criteria for medium-sized enterprises and whose indicators, as of the date of the annual financial statements for the year preceding the reporting year, meet at least two of the following criteria:

- book value of assets - more than EUR 20 million

- net income from sale of products (goods, works, services) - more than EUR 40 million

- the average number of employees is over 250 people

/22.jpg.aspx?lang=en-GB)

Public joint-stock companies

/33.jpg.aspx?lang=en-GB)

Enterprises operating in the extractive industries

Entities performing economic activities by types listed by the Cabinet of Ministers of Ukraine

In addition to the above categories, for which accounting in accordance with International Standards is mandatory, entities can independently decide on the transition to the IFRS accounting model in Ukraine.

Is your company on this list? We offer to order a consultation from BDO Ukraine specialists, who will help you find the right answers.

/Benefits-of-IFRS-eng.jpg.aspx?lang=en-GB)

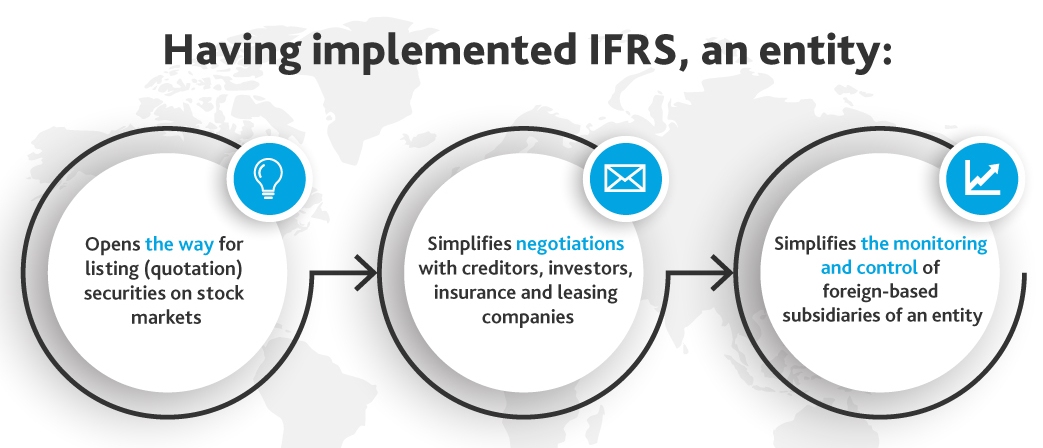

The economic and reputational benefits are a direct result of the transition to International Accounting Standards.

A team of certified (ACCA, FCCA) and experienced BDO in Ukraine’s professionals offers comprehensive IFRS services aimed at both ensuring compliance with International Financial Reporting requirements and minimizing disruptions in the clients’ activities.

BDO will help you understand and prepare for the upcoming changes. Our experts will help you manage this process, assessing the impact of new accounting standards or implementing thereof.

IFRS Illustrative Financial Statements (December 2024) IFRS Accounting Standards

If you need more information or want to order services for the implementation of international financial reporting, please contact BDO in Ukraine’s experts.

Roman Gruba

Frequently Asked Questions (FAQ) about IFRS Standards

1. Who is required to apply IFRS in Ukraine?

Public companies, banks, insurance companies, large enterprises, and other public interest entities.

In accordance with the Law of Ukraine No. 996-XIV, IFRSs are mandatory for public joint stock companies, banks, insurance companies, large enterprises, securities issuers, non-state pension funds, credit unions, financial institutions, enterprises extracting minerals of national importance, and parent companies of public interest groups.

2. What is the structure of financial statements under IFRS?

Balance sheet, statement of comprehensive income, cash flow, changes in equity, notes.

Financial statements prepared in accordance with IFRS include balance sheet (statement of financial position), statement of comprehensive income, statement of cash flows, statement of changes in equity, and notes to the financial statements disclosing accounting policies and other information.

3. How to transition to IFRS Standards?

Assessment, plan, training, policy adaptation, opening balance sheet, audit.

The transition to IFRS involves several key steps, including assessing the company’s readiness, developing a transition plan, training staff, adapting accounting policies, preparing an opening balance sheet as at the date of first-time adoption of IFRS, and auditing the first IFRS financial statements.

4. Can a LLC voluntarily switch to IFRS Standards?

Yes, any company can switch to IFRS Standards at its own discretion.

Yes, even if a company is not required to apply IFRS, it may voluntarily opt to do so to enhance transparency, attract investors or meet the requirements of its parent company.

5. What is the difference between NAS and IFRS?

IFRS Standards are international and flexible; NAS Standards are national and regulated.

NAS Standards are national accounting standards that regulate accounting in Ukraine. IFRS Standards are international standards that provide greater flexibility, transparency and comparability of financial reporting at a global level. IFRSs are designed for investors and users of financial statements, to support informed management and investment decisions.

6. Are all companies in Ukraine that prepare IFRS reporting required to submit taxonomy?

In Ukraine, not all companies that prepare IFRS reporting are required to submit them in taxonomy format (XBRL/iXBRL).

The requirement to submit financial statements in the IFRS taxonomy format via the FRS (the NSSMC financial reporting system) applies to the following:

That is, if a company voluntarily prepares financial statements in accordance with IFRS (e.g., for investors or owners), but is not included in the above list, it may submit reports in paper / electronic form without taxonomy.

IFRS Glossary