During wartime, Ukrainian businesses demonstrate adaptability but face a high rate of closures, especially among private entrepreneurs (PEs). The geographical unevenness of business activity is linked to security risks. Despite the introduction of tax reforms and support programmes by the government, frontline regions remain vulnerable.

The impact of war on the business environment

Ukrainian businesses are still operating in an environment where economic decisions are influenced by security risks and uncertainty on a daily basis. Entrepreneurs must be able to adapt to logistical disruptions, infrastructure loss and resource shortages. Simultaneously, they sustain the economy by creating jobs, generating tax revenues and laying the foundation for national recovery. In response, the government is taking measures to support the entrepreneurs by introducing tax relief, simplifying registration procedures and expanding programmes for small businesses.The business environment is characterised by a variety of dynamics: some entrepreneurs capitalise on new opportunities to launch projects, while others face challenges due to financial or operational constraints, leading to considerable variations in opening and closure statistics during the war.

Dynamics of transformation in the structure of entrepreneurship

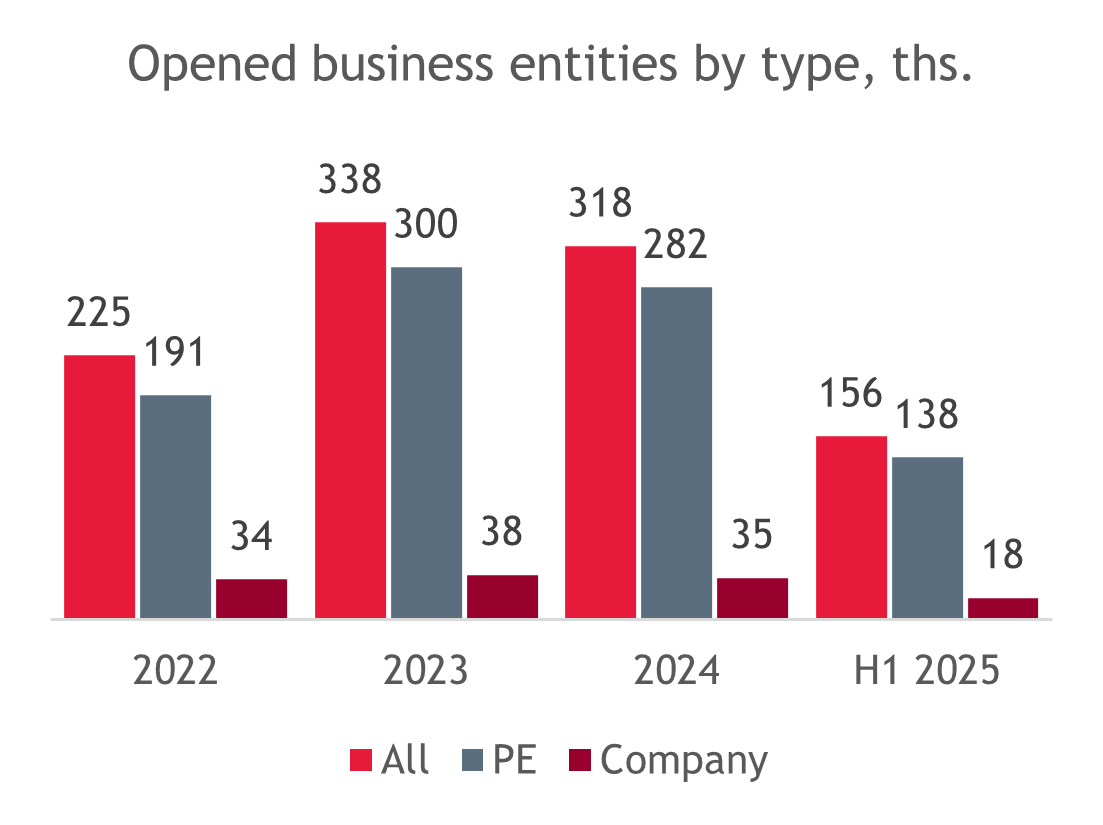

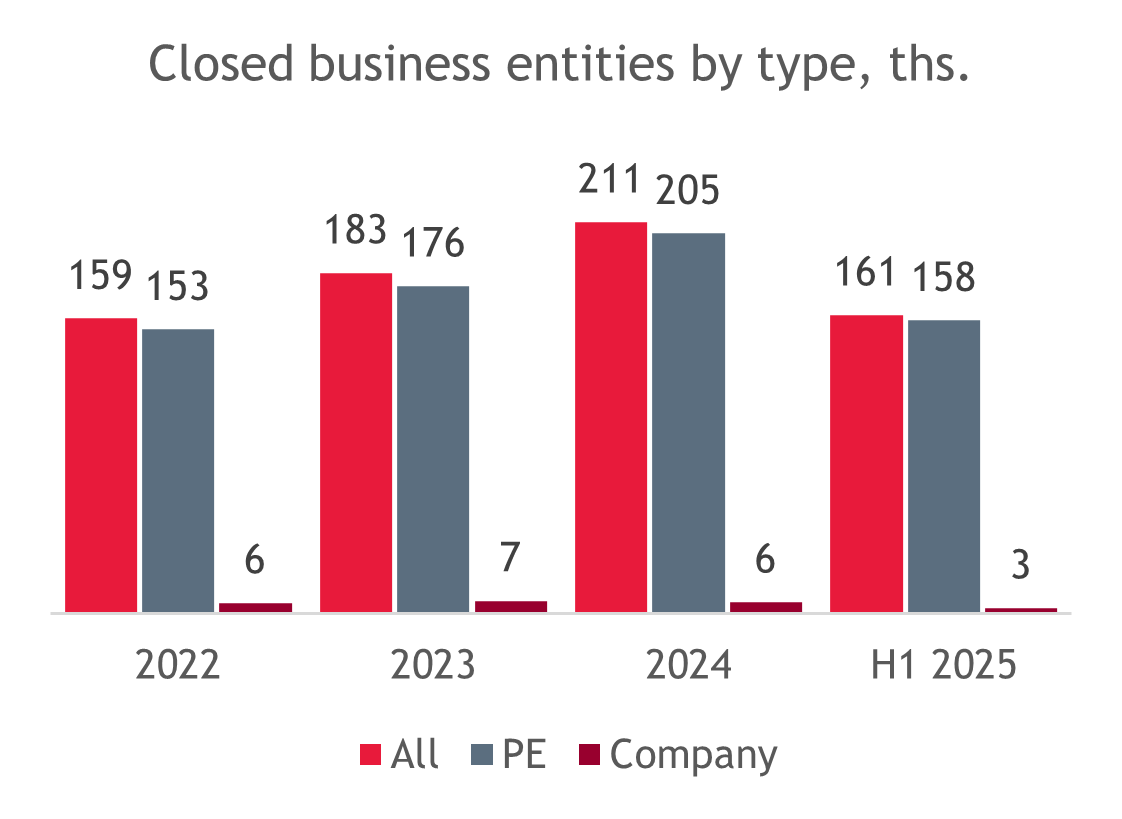

Business activity trends reflect a gradual shift in the ratio of entity openings to closures. From 2022 to 2024, the number of openings consistently exceeded the number of closures, indicating the entrepreneurs’ ability to adapt to crisis conditions. However, in the first half of 2025 this trend reversed, with the number of closed PEs exceeding new registrations and resulting in a negative balance.In the first half of 2025, the number of closures already surpassed the annual figure for 2022.

Based on YouControlMarket data

Based on YouControlMarket data

Over 95% of closures involve PEs, which highlights the increased vulnerability of microbusinesses to external and regulatory factors. In contrast, companies maintain a positive balance between openings and closures. Consequently, the entrepreneurial landscape is evolving towards reduced self-employment and a greater emphasis on more resilient organisational structures.

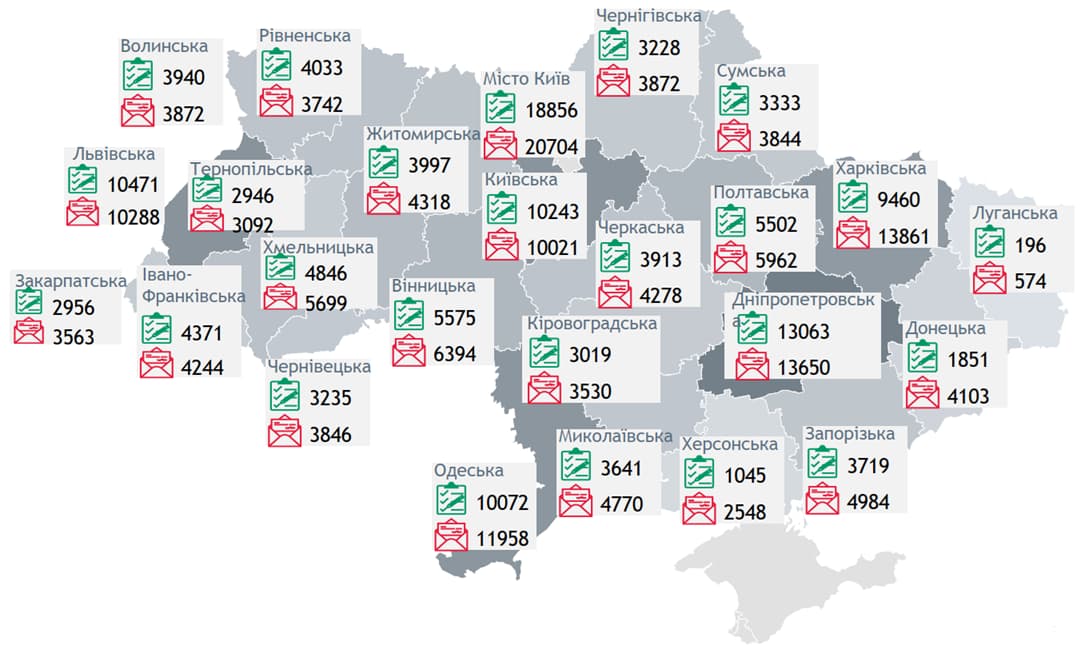

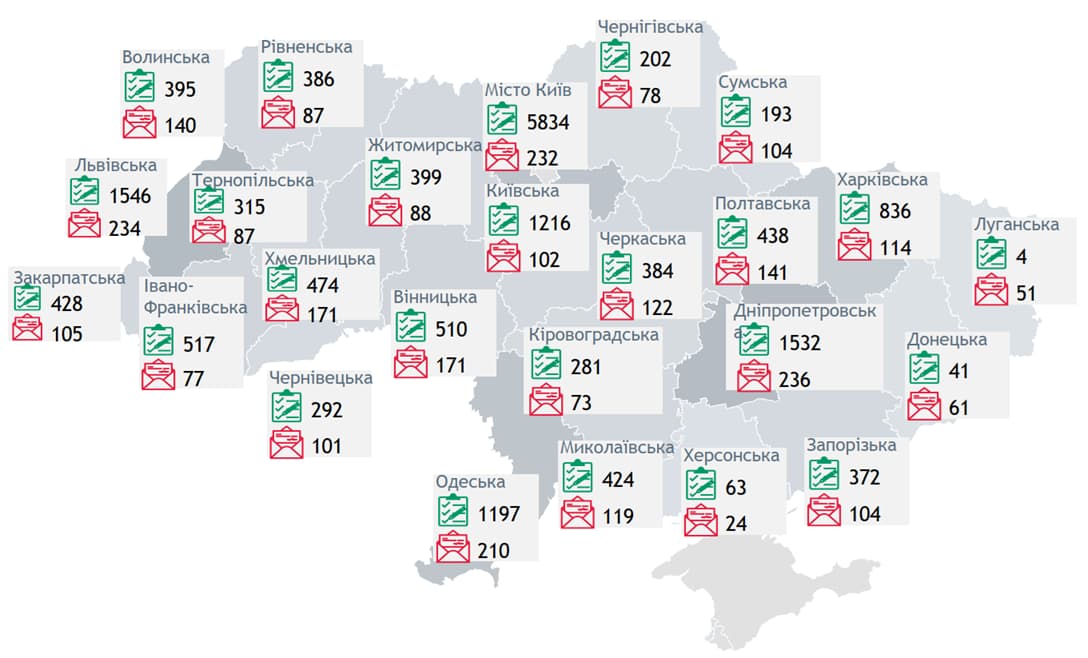

Geographical unevenness of business activity

The geographical distribution of business activity reflects regional unevenness that is directly tied to the course of military operations. In Kyiv and a number of western regions, which are relatively safe, with access to infrastructure and markets, there has been a concentration of new business initiatives. In contrast, in the key regions such as Donetsk, Luhansk, Kherson, and parts of Zaporizhzhia, business closures are significantly outpacing new openings. The key reasons for this include ongoing military threats, destruction of transport infrastructure and production, population outflow and limited access to government and donor support programmes.This results in a structural imbalance, with entrepreneurial resources and investment activity concentrating in safer regions, while high-risk zones experience a systematic decline in economic potential.

PE opening / closure dynamics — H1 2025

Based on YouControlMarket data

Company opening / closure dynamics — H1 2025

Based on YouControlMarket data

Key factors affecting the change dynamics

Cyberattack on the Unified State Register (USR)

The Unified State Register was offline from December 2024 to January 2025 due to a large-scale cyberattack. During this period, the registration actions were not possible. Following the restoration of access, a backlog of PE closures and openings was experienced, resulting in a substantial impact on H1 2025 statistics.

Tax changes effective 1 January 2025

- Mandatory military levy introduced for all PEs.

- Voluntary payment exemption for the Unified Social Tax (UST) cancelled, contributions are mandatory again.

- Monthly reporting introduced for PEs with employees, replacing quarterly reporting.

Closure of newly established PEs

Approximately 40% of PEs that ceased operations in 2025 were registered in 2023–2024. Over 5 thousand of these were in existence for less than two weeks, primarily used for short-term contracts or tax optimisation.

Limited business opportunities in frontline regions

In the Donetsk, Luhansk, Kherson, and Zaporizhzhia regions, closures significantly exceed openings. For example, 196 PEs were opened and 574 were closed in Luhansk. The driving force behind such dynamic is the presence of hostilities, destruction of infrastructure and population outflow.Business activity in frontline regions is severely restricted due to constant shelling, infrastructure damage and population displacement, making businesses unstable. Furthermore, numerous government and donor-funded programmes are inaccessible due to their proximity to the front line. Consequently, the number of closures far exceeds that of openings, resulting in a further economic decline. For instance, in Luhansk, the number of closed companies in H1 2025 was almost 13 times higher than the number of new ones.

Full version of the research available for download in Ukrainian.

What are the needs of Ukrainian businesses?

Investment and international support

Investments are required to restore infrastructure in high-risk regions and fund new entrepreneurial initiatives in more stable areas. A key component of this strategy is engaging international partners to finance the recovery process.

Targeted programmes for frontline regions

There is a need for targeted programmes to revive entrepreneurial activity, especially among the SMEs affected by hostilities. It is vital to establish secure business conditions, facilitate access to financing and ensure regulatory support. For instance, the White Paper by the European Business Association on supporting business in frontline regions, developed with assistance from BDO in Ukraine specialists, offers recommendations for entrepreneurship support in these areas.

Information and educational support

Given the high number of short-term registrations, there is a growing need to focus on indicators that reflect business sustainability. This applies to both government policy and analytical approaches, particularly in assessing support effectiveness or forecasting tax revenues.

Reducing administrative burden

Small businesses and especially PEs without employees require reduced tax and reporting burdens, together with expanded programmes to simplify reporting.

Information support

Entrepreneurs require training and consultation programmes to keep them informed of the tax changes and business support opportunities, and adapting to wartime business conditions.

Conclusion

Challenges create opportunities, and Ukrainian entrepreneurs are capable of turning crisis into growth. In the current climate of wartime instability, it is imperative that entrepreneurs, government bodies and international partners join forces to establish stable business conditions. Collaboration is the key to building a resilient economy — one that can adapt to challenges and support the recovery process.BDO in Ukraine plays a key role in supporting entrepreneurs during this transformation. Our team of experts is well-versed in providing consultations regarding tax changes, business process optimisation, available government and international support programmes, and helps develop strategies for the adaptation of business to new realities. We support entrepreneurs at every stage, from opening business to post-crisis recovery.

Contact us by filling out the form.