Manage your business with services of BDO in Ukraine. Trust the team of BDO experts in comprehensive financial, legal and tax expertise for your business.

Due Diligence is a procedure for independent verification of the company. Due Diligence is usually preceded by a merger and acquisition (M&A), establishment of a joint venture, or a partnership.

Due Diligence mainly includes a compliance check, involving comprehensive examination of operating activities, relations with counterparties and government agencies, possible adverse factors of the company's activities, etc.

Depending on the objectives of the Due Diligence procedure, there are:

- General Due Diligence — a comprehensive review of the main aspects of the company's activities, including financial condition, taxation, legal aspects, management, company's market share, etc.

- Financial Due Diligence — review of financial condition of the company, including assets and liabilities in terms of their assessment (off-balance sheet liabilities, impairment of inventories, etc.)

- Tax Due Diligence — identification of tax risks and an objective assessment of all tax aspects of doing business.

- Legal Due Diligence — analysis of legal aspects of the company's operation, for example, registration of intellectual property rights, court cases, etc

- Vendor Due Diligence — Due Diligence, where the customer is the company itself or its current owner.

- Operational Due Diligence — verification of operating activities, in particular, the level of capacity utilization, the possibility of changes in the range, increase of production.

- Technological Due Diligence — study of the production technology, equipment condition.

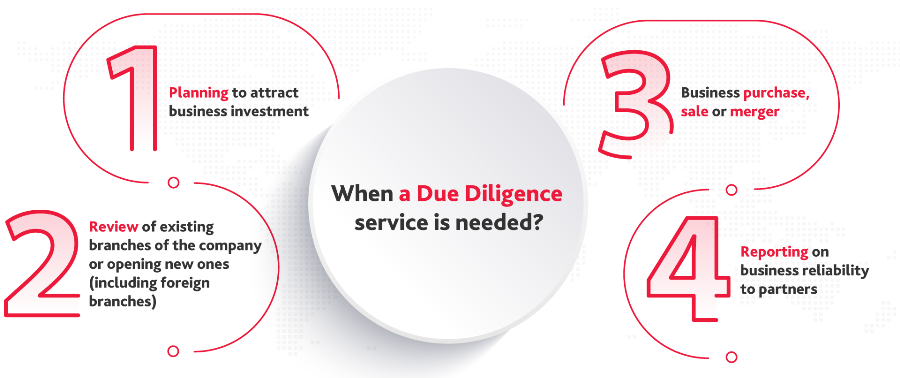

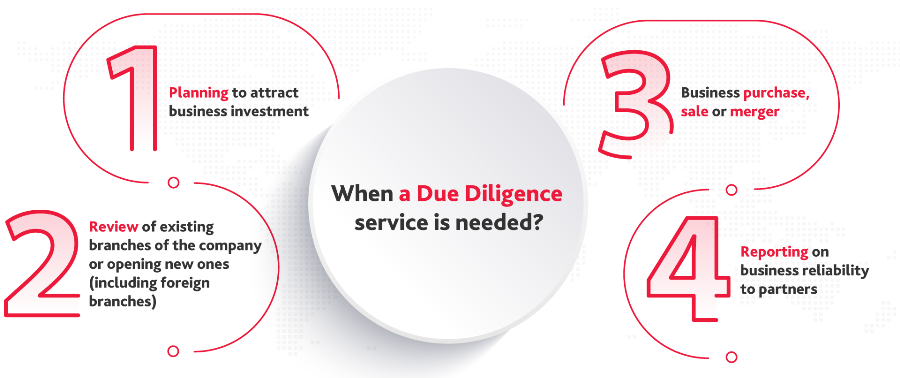

When a Due Diligence service is needed?

BDO in Ukraine provides General, Financial, Tax, Legal and Vendor Due Diligence services.

Why is engaging BDO to perform Due Diligence procedures the best solution?

- Risk mitigation — we provide the most complete transparent picture on all issues of the auditee. This allows us to reduce the risk in making important strategic decisions for our clients.

- Many years of experience, including 27 years in Ukraine, allows us to know the needs of our customers when ordering Due Diligence. This ensures the maximum completion of the task and accurate identification of problem points of the auditee.

- Quality — high qualification of specialists and strict international internal standards of BDO guarantee the implementation of each project at the highest level.

- Globality — we are the members of the international firm represented in 167 countries around the world. If necessary, we build business communications on all issues of our clients (not only financial, but also other areas) all over the world.

- Confidentiality — we guarantee complete security of data we work with. This is stipulated in the standards of our international network and is tightly controlled by the head office. In addition, this is a requirement of the Audit Chamber of Ukraine, whose tests our company successfully passes every year.

If you need additional information or want to order a consultation on the Due Diligence for your business, please contact the specialists of BDO in Ukraine.