Access to EU Finance – How it works?

Who is eligible for EU funding?

EU Funding is available for all types of companies of any size and sector.

A wide range of financing is available: loans, microfinance and venture capital. Every year the EU supports more than 200 000 businesses. The EU also supports businesses with grants and contracts.

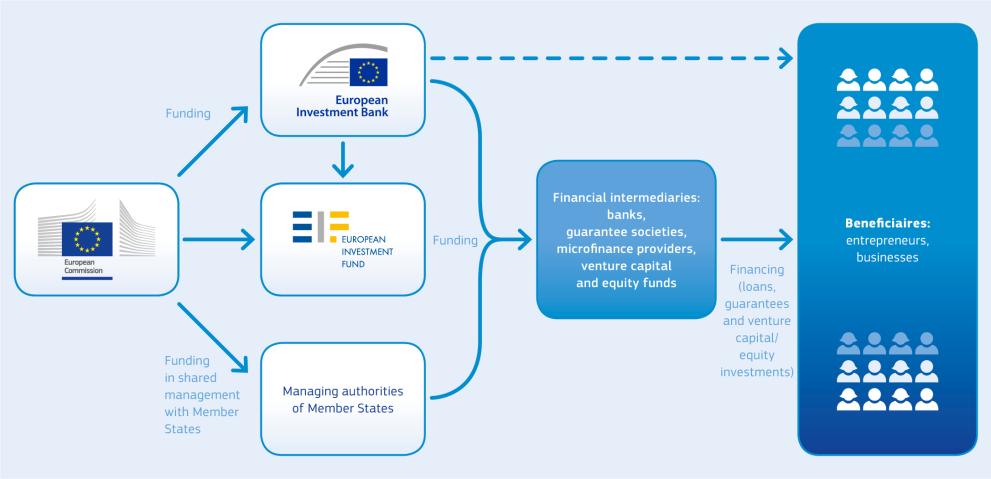

How it works

The decision to provide EU financing will be made by the local financial institutions such as banks, venture capitalists or angel investors.

Thanks to the EU support the local financial institutions can provide additional financing to businesses.

The exact financing conditions – the amount, duration, interest rates and fees – are determined by these financial institutions.

You can contact one of over 20 banks in Ukraine to find out more.

Your right for credit feedback

You have a right to get feedback from credit institutions on their credit decision.

This can help you understand your financial position and improve your chances to obtain financing in the future.

Use your right and refer to Article 431 of the EU Capital Requirements Regulation.

Source - Access to EU Finance - Access to EU Finance - European Commission (europa.eu)

Selected Banks in Ukraine

Financial intermediaries | Type of finance | Investment focus | Amounts of Finance | Additional information | Sources of finance |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 9,999,999,999 EUR | Focus: Agriculture sector | EFSE |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 9,999,999,999 EUR | Focus: Agriculture sector | EFSE |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 9,999,999,999 EUR | EFSE, Other | |

| Loan/ Guarantee | All sectors/ general, Leasing | Min: 0 EUR Max: 9,999,999,999 EUR | EFSE | |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 25,000,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general, Research, Development, Innovation | Min: 25,000 EUR Max: 7,500,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 9,999,999,999 EUR | EFSE | |

| Loan/ Guarantee | All sectors/ general, Digitalisation, Research, Development, Innovation | Min: 25,000 EUR Max: 7,500,000 EUR | InnovFin | |

| Loan/ Guarantee | All sectors/ general | Min: 0 EUR Max: 9,999,999,999 EUR | EFSE, Other | |

| Loan/ Guarantee | All sectors/ general, Research, Development, Innovation | Min: 25,000 EUR Max: 7,500,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

PJSC "West Finance and Credit Bank" (APEX Loan)

| Loan/ Guarantee | All sectors/ general, Research, Development, Innovation | Min: 25,000 EUR Max: 7,500,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

State Export-Import Bank of Ukraine (JSC Ukreximbank)

| Loan/ Guarantee | All sectors/ general, Research, Development, Innovation | Min: 25,000 EUR Max: 7,500,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

State Savings Bank ofUkraine JSC (Oschadbank)

| Loan/ Guarantee | All sectors/ general, Research, Development, Innovation | Min: 25,000 EUR Max: 7,500,000 EUR | EIB loans can be used to finance all tangible and intangible investments. Support of internationalisation | EIB |

| Loan/ Guarantee, Equity/ Venture capital, Other | All sectors/ general | Min: 0 EUR Max: 9,999,999,999 EUR | EU is supporting small and medium enterprises (SMEs) in Ukraine through its initiative EU4Business. At this platform, you may learn how to get a credit or a grant, improve your business development skills and get access to new markets | Other |